Unleash the Power of Modified IRR

Modified Internal Rate of Return (MIRR) is a powerful financial tool that offers a refined perspective on investment analysis. While the traditional Internal Rate of Return (IRR) method has its merits, MIRR introduces additional dimensions, making it an invaluable asset for evaluating investment opportunities. This article delves into the intricacies of MIRR, exploring its calculation, advantages, and real-world applications, providing a comprehensive guide to harnessing its potential.

Understanding the Modified IRR Concept

MIRR is an enhanced version of the IRR concept, addressing certain limitations of the traditional IRR. It considers the reinvestment rate of cash flows and provides a more accurate representation of an investment’s true return. By incorporating this reinvestment rate, MIRR offers a comprehensive understanding of an investment’s potential, making it a preferred choice for sophisticated financial analysis.

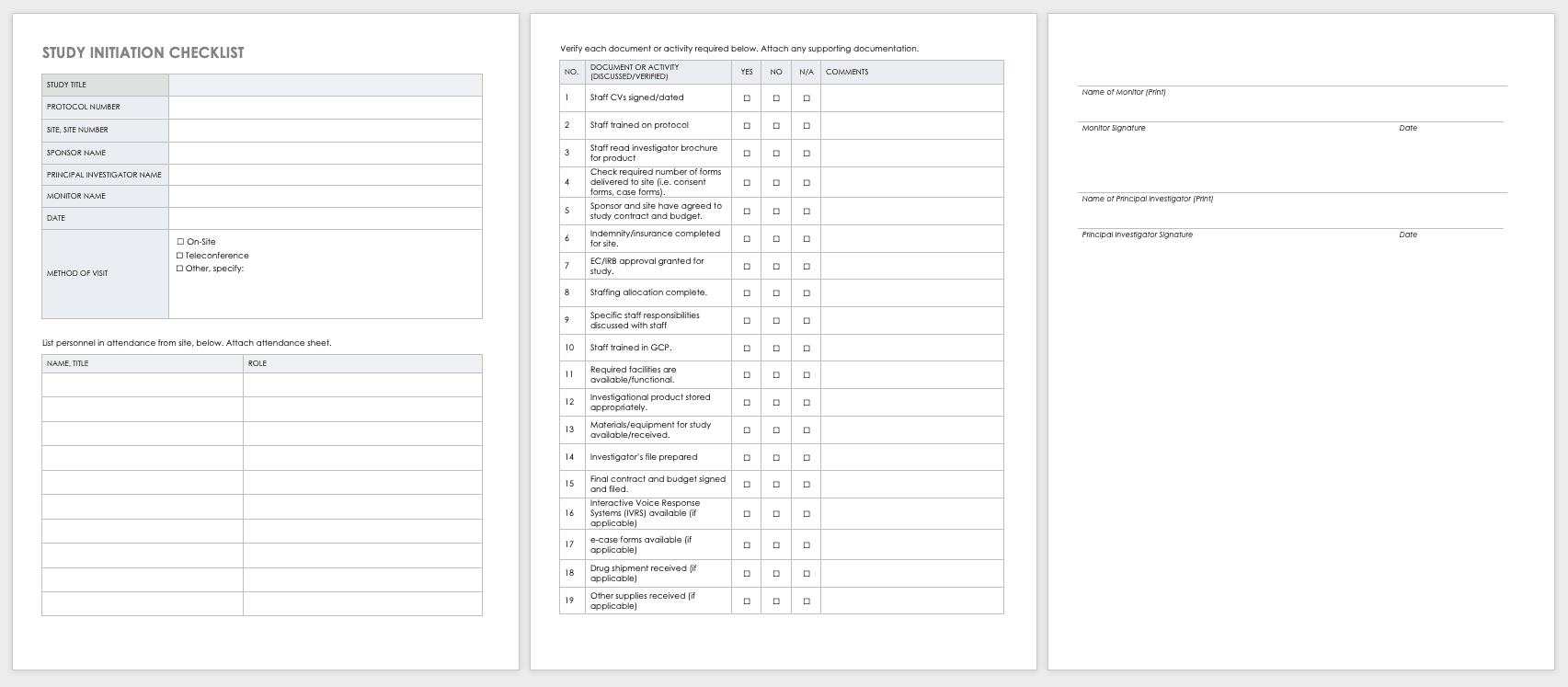

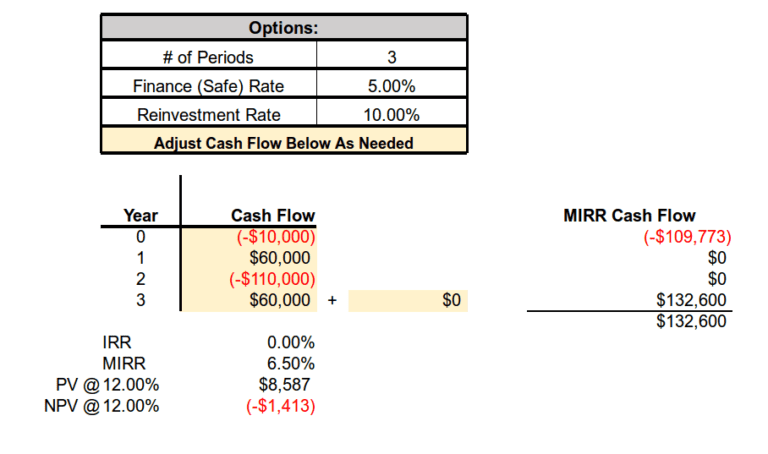

Calculation of MIRR: A Step-by-Step Guide

Calculating MIRR involves a multi-step process that accounts for both positive and negative cash flows. Here’s a detailed breakdown of the steps:

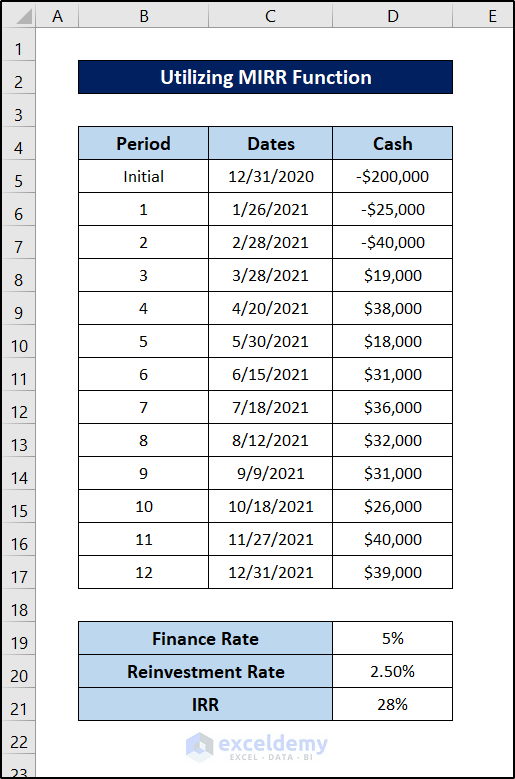

- Identify the Cash Flows: Begin by analyzing the cash flows associated with the investment. This includes all positive cash inflows (such as revenue or income) and negative cash outflows (expenses or investments).

- Determine the Reinvestment Rate: This rate represents the expected return on reinvested cash flows. It is crucial to select an appropriate rate that aligns with the investment’s nature and market conditions.

- Calculate the Future Value of Positive Cash Flows: Using the reinvestment rate, determine the future value of each positive cash flow. This step involves compounding the cash flows over time.

- Calculate the Present Value of Negative Cash Flows: Apply the discount rate, typically the cost of capital, to determine the present value of negative cash flows. This step accounts for the time value of money.

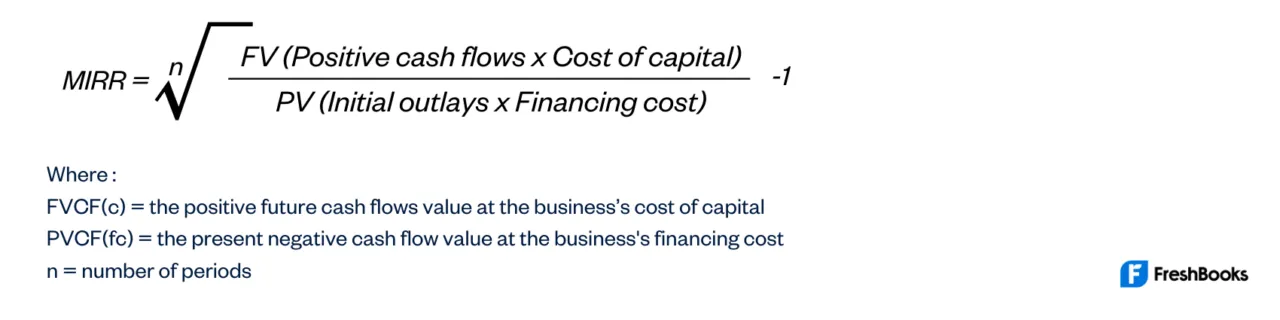

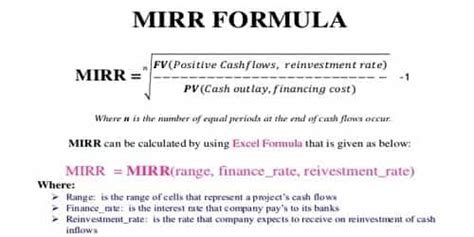

- Compute the MIRR: The MIRR is calculated by treating the future values of positive cash flows as a single cash flow and the present values of negative cash flows as another. The formula for MIRR is: MIRR = (FV of Positive Cash Flows / PV of Negative Cash Flows)^((1 / Number of Periods) - 1)

Advantages of Using MIRR

MIRR offers several advantages over traditional IRR, making it a preferred choice for investment analysis. Here are some key benefits:

- Reinvestment Rate Consideration: MIRR accounts for the reinvestment rate, providing a more realistic assessment of an investment’s return. This is particularly beneficial when the reinvestment rate differs from the discount rate.

- Consistency in Cash Flow Treatment: MIRR treats positive and negative cash flows consistently, ensuring a balanced evaluation. Unlike IRR, MIRR does not assume that positive cash flows are reinvested at the IRR rate, avoiding potential distortions.

- Accurate Project Evaluation: By considering the reinvestment rate, MIRR offers a more precise representation of an investment’s true return. This accuracy is crucial for making informed investment decisions and comparing projects.

- Alignment with Financial Theory: MIRR aligns with modern financial theory, reflecting the time value of money and the concept of opportunity cost. It provides a more sophisticated analysis, making it a preferred tool for complex financial assessments.

Real-World Applications of MIRR

MIRR finds extensive applications across various industries and investment scenarios. Here are some practical use cases:

- Capital Budgeting: In capital budgeting decisions, MIRR helps evaluate the profitability of long-term investments. It provides a comprehensive understanding of the expected return, allowing businesses to make informed choices.

- Project Comparison: MIRR is invaluable when comparing multiple investment projects. By considering the reinvestment rate, it offers a fair and consistent evaluation, enabling businesses to prioritize projects based on their true returns.

- Investment Portfolio Management: Financial advisors and portfolio managers utilize MIRR to assess the performance of investment portfolios. It provides a clear picture of the overall return, aiding in strategic asset allocation and portfolio optimization.

- Public Sector Investments: Governments and public entities often employ MIRR to evaluate large-scale infrastructure projects. By considering the reinvestment rate, MIRR ensures a realistic assessment of the project’s financial viability.

MIRR in Action: A Case Study

Let’s consider a practical example to illustrate the application of MIRR. Imagine a company evaluating two potential investment projects:

| Project | Initial Investment | Cash Flows | Reinvestment Rate | MIRR |

|---|---|---|---|---|

| A | $100,000 | Year 1: $20,000 Year 2: $30,000 Year 3: $40,000 |

8% | 12.13% |

| B | $150,000 | Year 1: $15,000 Year 2: $25,000 Year 3: $35,000 |

6% | 9.52% |

In this case, Project A, with a MIRR of 12.13%, is a more attractive investment opportunity compared to Project B, which has a MIRR of 9.52%. MIRR helps the company make an informed decision by considering the reinvestment rate and providing a clear comparison between the projects.

Best Practices for Implementing MIRR

To maximize the benefits of MIRR, consider the following best practices:

- Accurate Data: Ensure that the cash flow data is accurate and complete. Inaccurate or missing data can lead to erroneous MIRR calculations.

- Realistic Reinvestment Rate: Select a reinvestment rate that aligns with the investment’s characteristics and market conditions. A realistic rate ensures a more precise MIRR.

- Sensitivity Analysis: Perform sensitivity analysis to understand how changes in the reinvestment rate affect the MIRR. This analysis provides insights into the investment’s robustness.

- Compare with Other Metrics: While MIRR is a powerful tool, it is beneficial to compare it with other financial metrics like Net Present Value (NPV) and Payback Period. A comprehensive analysis provides a holistic view.

MIRR’s Impact on Financial Decision-Making

The adoption of MIRR has a significant impact on financial decision-making. By offering a refined perspective on investment returns, MIRR enables businesses and investors to make more informed choices. It helps identify high-potential investments, optimize capital allocation, and minimize financial risks. MIRR’s accuracy and consistency make it a trusted tool for financial professionals, guiding strategic decisions and driving business success.

Conclusion

Modified Internal Rate of Return (MIRR) is a powerful financial tool that enhances investment analysis. By considering the reinvestment rate, MIRR offers a more accurate representation of an investment’s return. Its advantages, including consistency and alignment with financial theory, make it a preferred choice for evaluating complex investment scenarios. With its practical applications and impact on decision-making, MIRR plays a crucial role in guiding businesses and investors towards successful financial strategies.

What is the primary difference between MIRR and IRR?

+

MIRR and IRR are both methods used to evaluate investment returns, but they differ in their approach. IRR assumes that positive cash flows are reinvested at the IRR rate, which may not always be realistic. MIRR, on the other hand, considers a separate reinvestment rate, providing a more accurate representation of the investment’s true return.

How does MIRR treat negative cash flows?

+

MIRR treats negative cash flows as costs that need to be financed. These cash outflows are discounted using the cost of capital or the financing rate to determine their present value. This approach ensures a fair evaluation of the investment’s overall return.

Can MIRR be used for projects with varying cash flow patterns?

+

Absolutely! MIRR is highly adaptable and can be applied to projects with irregular cash flow patterns. It provides a consistent evaluation, making it suitable for a wide range of investment scenarios, regardless of the complexity of cash flows.