Mastering the Art of ACT/365 to ACT/360 Conversion

Converting dates from one day-count convention to another is a common task in finance, especially when dealing with bond pricing and interest calculations. The ACT/365 and ACT/360 conventions are two widely used methods, and understanding the nuances of their conversion is crucial for accurate financial analysis and reporting.

Understanding the ACT/365 and ACT/360 Conventions

In finance, day-count conventions define how interest accrues over time for various financial instruments. The ACT/365 and ACT/360 conventions are specific methods used to calculate the number of days between two dates, which is essential for determining interest rates and bond prices.

ACT/365

The ACT/365 convention, also known as the Actual/365 or Actual/Actual method, is a day-count convention that counts the actual number of days between two dates, using the actual number of days in a given year. This method is widely used in financial markets, particularly for bonds and interest rate calculations.

For example, if we have a bond with a coupon payment date of March 15, 2023, and the settlement date is February 1, 2023, the ACT/365 convention would count the exact number of days between these dates, which is 44.

ACT/360

The ACT/360 convention, or Actual/360, is another day-count convention that assumes every month has 30 days and a year has 360 days. It simplifies interest calculations by using a fixed day count for every month. This method is commonly used in the United States for bond pricing and interest rate computations.

Using the same bond example, if we apply the ACT/360 convention to calculate the number of days between March 15, 2023, and February 1, 2023, it would result in 45 days, assuming each month has 30 days.

The Need for Conversion

While both ACT/365 and ACT/360 are widely used, financial institutions and markets often need to convert between these conventions for various reasons. Here are some common scenarios:

- Bond Pricing: When pricing bonds, traders and analysts may need to convert between ACT/365 and ACT/360 to ensure consistent calculations and comparisons.

- Interest Rate Calculations: Interest rates, such as LIBOR or swap rates, are often quoted using one convention, while financial institutions may prefer to use another for internal calculations.

- Market Consistency: Some financial markets have standardized on one convention, while others use a different one. Converting between conventions helps ensure consistent analysis and reporting across different markets.

- Regulatory Compliance: Regulatory bodies may require financial institutions to use specific day-count conventions for compliance purposes. Converting between conventions is necessary to meet these requirements.

The Conversion Process

Converting between ACT/365 and ACT/360 involves a straightforward calculation, but it’s important to ensure accuracy and consistency. Here’s a step-by-step guide to the conversion process:

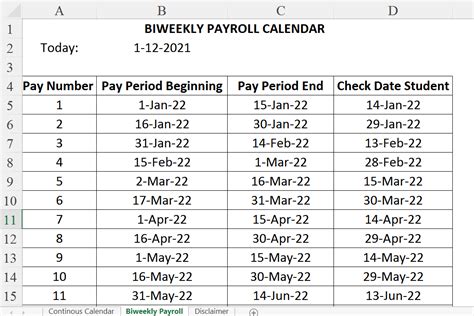

- Identify the Dates: Determine the start and end dates for which you need to calculate the day count.

- Calculate ACT/365: Count the actual number of days between the start and end dates. For example, if the dates are March 1, 2023, and May 15, 2023, the ACT/365 count would be 75 days.

- Convert to ACT/360: To convert the ACT/365 count to ACT/360, multiply the number of days by 360 and divide by 365. In the above example, 75 days * (360/365) would give you an ACT/360 count of approximately 74.52 days.

- Rounding: Depending on the context and precision required, you may need to round the converted value. In financial calculations, it's common to round to the nearest day.

| Date | ACT/365 | ACT/360 |

|---|---|---|

| March 1, 2023 - May 15, 2023 | 75 days | 74.52 days (rounded to 75 days) |

Common Challenges and Best Practices

While the conversion process is straightforward, there are some challenges and best practices to keep in mind:

Leap Years

Leap years can impact the accuracy of day-count calculations. The ACT/365 convention counts the actual number of days in a leap year, while the ACT/360 convention treats every year as having 360 days. This difference can lead to slight variations in day counts.

Precision and Rounding

Financial calculations often require precision. When converting between day-count conventions, it’s important to consider the level of precision needed for the specific calculation. Rounding can impact the final result, so choose an appropriate rounding method based on the context.

Standardization

To ensure consistency and avoid errors, it’s beneficial to standardize the day-count convention within an organization. This reduces the risk of confusion and ensures that all financial calculations and reports are aligned.

Automation

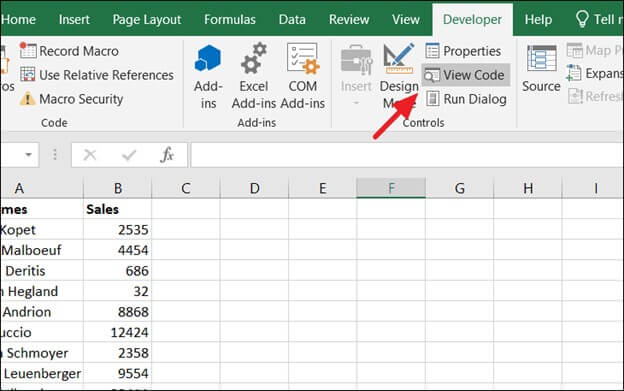

Manual calculations can be time-consuming and error-prone. Consider using financial software or programming languages with built-in functions for day-count conversions. Automation improves efficiency and reduces the likelihood of human errors.

Conclusion

Converting between ACT/365 and ACT/360 is a fundamental skill in finance, especially when working with bonds and interest rates. By understanding the conventions, following a clear conversion process, and considering best practices, financial professionals can ensure accurate and consistent calculations. This mastery of day-count conversions is crucial for maintaining financial integrity and making informed decisions.

FAQ

What is the primary difference between ACT/365 and ACT/360 conventions?

+The primary difference lies in their approach to counting days. ACT/365 counts the actual number of days between two dates, considering the varying lengths of months and leap years. On the other hand, ACT/360 assumes a fixed count of 30 days per month and 360 days per year, simplifying calculations.

Why do financial institutions need to convert between these conventions?

+Conversion is necessary for consistent analysis and reporting. Financial institutions often work with different markets and instruments that use different conventions. Converting ensures that calculations and comparisons are accurate and aligned with industry standards.

Are there any specific financial products that primarily use ACT/365 or ACT/360?

+Yes, certain financial products have standardized on specific conventions. For example, many Eurobonds use ACT/365, while some US dollar-denominated bonds use ACT/360. Understanding the convention used by a specific financial product is crucial for accurate calculations.