How Many Biweekly Pay Periods in 2025?

Navigating the 2025 Payroll Calendar: Understanding Biweekly Pay Periods

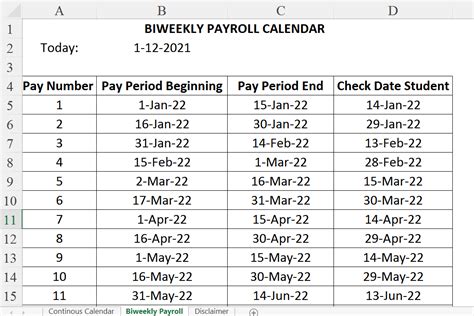

In the realm of payroll and compensation management, understanding the intricacies of pay periods is crucial for both employers and employees. As we look ahead to 2025, it's essential to grasp the number of biweekly pay periods that will occur throughout the year. This knowledge is not only beneficial for budgeting and financial planning but also for ensuring compliance with payroll regulations.

A biweekly pay period is a common payroll schedule where employees are paid every two weeks, resulting in 26 pay periods over the course of a year. However, the actual number of biweekly pay periods in a given year can vary due to the unique calendar structure and the occurrence of leap years. In 2025, there will be a notable variation in the number of biweekly pay periods, presenting a unique challenge for payroll administrators.

The 2025 Payroll Calendar: A Detailed Breakdown

To navigate the payroll calendar effectively, let's delve into the specifics of the 2025 biweekly pay periods. Understanding this calendar is crucial for employers to manage payroll accurately and for employees to anticipate their pay dates throughout the year.

January to March: Starting the Year with 6 Pay Periods

The year 2025 kicks off with a standard biweekly payroll schedule. From January 1st to March 25th, there will be a total of 6 biweekly pay periods. This period includes the usual two-week intervals, with pay dates falling on the 1st and 15th of each month, as well as the 31st of January and the 25th of March.

| Pay Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| Period 1 | Jan 1st | Jan 14th | Jan 15th |

| Period 2 | Jan 15th | Jan 28th | Jan 31st |

| Period 3 | Jan 29th | Feb 11th | Feb 12th |

| Period 4 | Feb 12th | Feb 25th | Feb 26th |

| Period 5 | Feb 26th | Mar 11th | Mar 12th |

| Period 6 | Mar 12th | Mar 25th | Mar 26th |

This initial period of the year follows a straightforward biweekly pattern, making it relatively easy to plan and manage payroll. However, as we move further into the year, the calendar presents some interesting variations.

April to June: The 27th Pay Period

The months of April to June bring a unique challenge to the 2025 payroll calendar. During this period, we encounter an additional pay period, resulting in a total of 7 biweekly pay periods instead of the usual 6. This occurs due to the specific arrangement of dates in 2025, where the pay period starting on April 1st ends on June 17th, spanning a full 13 weeks.

| Pay Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| Period 7 | Mar 26th | Apr 8th | Apr 9th |

| Period 8 | Apr 9th | Apr 22nd | Apr 23rd |

| Period 9 | Apr 23rd | May 6th | May 7th |

| Period 10 | May 7th | May 20th | May 21st |

| Period 11 | May 21st | Jun 3rd | Jun 4th |

| Period 12 | Jun 4th | Jun 17th | Jun 18th |

| Period 13 | Jun 18th | Jul 1st | Jul 2nd |

The presence of the 27th pay period is a significant deviation from the standard 26 biweekly pay periods in a non-leap year. This additional period can impact payroll budgeting and planning, requiring careful consideration to ensure accurate compensation.

July to September: Back to the Standard 6 Pay Periods

As we move into the second half of 2025, the payroll calendar returns to a more familiar pattern. From July 2nd to September 23rd, there will be a standard 6 biweekly pay periods, following the typical two-week intervals. This period provides a breather after the unique situation of the 27th pay period earlier in the year.

| Pay Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| Period 14 | Jul 2nd | Jul 15th | Jul 16th |

| Period 15 | Jul 16th | Jul 29th | Jul 30th |

| Period 16 | Jul 30th | Aug 12th | Aug 13th |

| Period 17 | Aug 13th | Aug 26th | Aug 27th |

| Period 18 | Aug 27th | Sep 9th | Sep 10th |

| Period 19 | Sep 10th | Sep 23rd | Sep 24th |

October to December: Closing the Year with 7 Pay Periods

The final quarter of 2025 mirrors the first quarter in terms of pay periods. From October 1st to December 30th, there will be 7 biweekly pay periods, again due to the unique calendar arrangement. This period concludes the year with a slightly accelerated payroll schedule.

| Pay Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| Period 20 | Sep 24th | Oct 7th | Oct 8th |

| Period 21 | Oct 8th | Oct 21st | Oct 22nd |

| Period 22 | Oct 22nd | Nov 4th | Nov 5th |

| Period 23 | Nov 5th | Nov 18th | Nov 19th |

| Period 24 | Nov 19th | Dec 2nd | Dec 3rd |

| Period 25 | Dec 3rd | Dec 16th | Dec 17th |

| Period 26 | Dec 17th | Dec 30th | Dec 31st |

The year 2025 presents a unique payroll calendar with its variations in biweekly pay periods. By understanding this calendar, employers and employees can navigate payroll processes with precision and accuracy, ensuring a seamless experience throughout the year.

The Impact on Payroll Management

The variations in biweekly pay periods throughout 2025 have significant implications for payroll management. For employers, it becomes crucial to adapt payroll processes to accommodate the extra pay periods in certain months. This may involve adjusting payroll budgets, ensuring compliance with tax regulations, and communicating pay date changes to employees.

From an employee perspective, understanding the payroll calendar is essential for financial planning. The presence of additional pay periods can impact budgeting and savings goals. Employees should be aware of these variations to manage their finances effectively and anticipate any changes in their pay schedule.

Planning for the Future: Beyond 2025

While 2025 presents a unique payroll calendar, it's important to consider the long-term implications for payroll planning. Understanding the patterns and variations in biweekly pay periods can help employers and employees prepare for future years. By analyzing past payroll calendars and identifying trends, organizations can develop robust payroll strategies that account for potential variations.

For instance, in leap years, such as 2024, the number of biweekly pay periods may differ due to the added day in February. Employers should be proactive in reviewing their payroll calendars annually to ensure accuracy and compliance.

Conclusion: Embracing the Payroll Calendar

In the complex world of payroll management, understanding the intricacies of the payroll calendar is paramount. By comprehensively examining the biweekly pay periods in 2025, employers and employees can navigate payroll processes with confidence and precision. The variations in pay periods provide a unique challenge, but with proper planning and awareness, they can be effectively managed.

As we look ahead to future years, a deep understanding of payroll calendars will continue to be a vital aspect of effective payroll management. By staying informed and adapting to the unique calendar variations, organizations can ensure accurate compensation, maintain compliance, and foster a positive relationship with their employees.

Frequently Asked Questions

How do I adjust my payroll budget for the extra pay period in 2025?

+

To adjust your payroll budget for the extra pay period in 2025, you’ll need to allocate additional funds for employee compensation during those months. Consider the increased payroll costs and ensure your budget accounts for this variation.

What impact does the extra pay period have on employee earnings and tax calculations?

+

The extra pay period can impact employee earnings, as they receive an additional paycheck. It’s important to ensure accurate tax calculations to avoid any discrepancies. Consult with your payroll provider or tax advisor for guidance on handling tax obligations during this period.

Are there any common challenges associated with managing payroll during periods with an extra pay period?

+

Managing payroll during periods with an extra pay period can present challenges such as ensuring accurate time tracking, calculating overtime, and managing payroll tax obligations. Stay organized, communicate with your payroll team, and seek professional advice if needed.