Maximise Your Online VAT Returns

In the ever-evolving landscape of e-commerce and online business, staying compliant with Value Added Tax (VAT) regulations is a critical aspect of running a successful and legally sound operation. This comprehensive guide aims to delve into the intricacies of online VAT returns, providing you with the tools and insights to optimize your processes and ensure smooth financial management.

The Evolution of Online VAT Returns

As the digital economy continues to expand, the complexities of VAT have become increasingly prominent for online businesses. With the introduction of new regulations and the need for precise, automated systems, optimizing your VAT returns has never been more crucial.

Let's take a closer look at how you can enhance your online VAT return process and stay ahead of the curve.

Understanding the Basics of Online VAT

For any business operating in the digital sphere, a solid understanding of online VAT is essential. Online VAT refers to the Value Added Tax that is applicable to goods and services sold over the internet. This includes everything from e-commerce platforms to digital downloads and online subscriptions.

The key to a successful online VAT strategy lies in two critical areas: compliance and efficiency. Ensuring you meet all the necessary legal requirements while streamlining your processes to minimize costs and effort is paramount.

Compliance: Navigating the Legal Landscape

Staying compliant with VAT regulations is non-negotiable. Non-compliance can lead to severe penalties, including fines and even legal action. Here’s a breakdown of the essential compliance considerations for online VAT:

- Registration: Ensure you are properly registered for VAT in all jurisdictions where your business operates or sells goods/services. This often involves registering with the relevant tax authorities and providing them with accurate business information.

- Tax Rates: Understand the applicable tax rates for your products or services in each market. These rates can vary significantly, and getting them wrong can lead to over or undercharging your customers, which has legal and financial implications.

- Reporting Periods: Know the reporting periods for VAT in each jurisdiction. These periods dictate when you need to file your VAT returns and pay the tax to the relevant authorities. Missing deadlines can result in penalties.

- Record-Keeping: Maintain accurate and detailed records of all your sales, purchases, and any other transactions that may be subject to VAT. This includes keeping invoices, receipts, and any other relevant documentation.

- Distance Selling: If you sell goods to customers in other EU countries, you may need to register for distance selling in those countries once you exceed the relevant threshold. This involves additional reporting and compliance requirements.

Efficiency: Streamlining Your VAT Returns

While compliance is vital, so too is efficiency. Streamlining your online VAT returns can save your business time, effort, and resources. Here are some strategies to consider:

- Automate Data Collection: Utilize software or platforms that can automatically collect and collate data related to your sales, purchases, and other VAT-relevant transactions. This can significantly reduce the manual effort required for data entry and minimize the risk of errors.

- Choose the Right VAT Calculation Method: Different countries and jurisdictions may have different methods for calculating VAT. Choose the most appropriate method for your business, ensuring it aligns with your pricing strategy and market expectations.

- Implement a Robust Accounting System: Invest in an accounting system that is specifically designed to handle online VAT. These systems can help you manage your transactions, calculate VAT accurately, and generate the necessary reports for filing your returns.

- Regularly Review and Update Your Processes: VAT regulations can change, and your business may evolve over time. Regularly review your VAT processes to ensure they remain efficient and compliant. Stay informed about any regulatory changes that may impact your business.

- Outsource VAT Compliance: Consider outsourcing your VAT compliance to a specialist firm or accountant. This can free up your internal resources and ensure that your VAT returns are completed accurately and on time.

Maximizing Your Online VAT Returns: Advanced Strategies

Once you’ve mastered the basics of online VAT, it’s time to explore more advanced strategies to further optimize your returns.

Utilizing Technology for VAT Optimization

The digital age has brought with it a plethora of technological tools that can revolutionize your VAT processes. Here are some ways technology can enhance your online VAT returns:

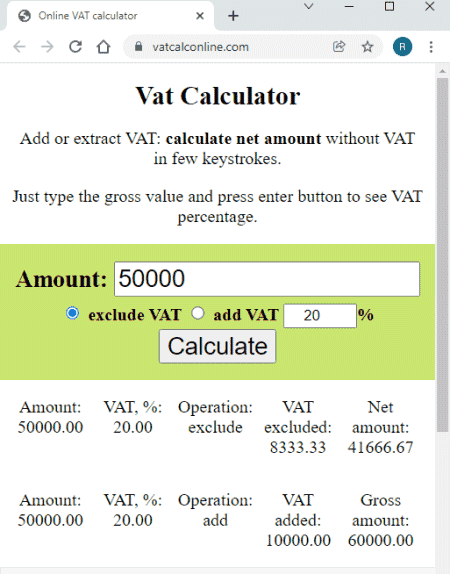

- VAT Calculation Software: Invest in software that can automatically calculate VAT based on your sales data. These tools can ensure accuracy and save you time, especially if you have a high volume of transactions.

- VAT Reporting Tools: Utilize tools that can generate the necessary reports for filing your VAT returns. These tools can automate the process, reducing the risk of errors and ensuring timely submissions.

- Data Analytics: Employ data analytics to gain insights into your sales patterns, customer behavior, and tax rates. This information can help you make informed decisions about your pricing strategy and VAT planning.

- Integration with E-commerce Platforms: If you operate an e-commerce business, integrate your VAT software or tools with your e-commerce platform. This can ensure that VAT is calculated accurately for each transaction and that the necessary data is readily available for reporting.

Exploring VAT Recovery Options

VAT recovery, also known as input tax recovery, refers to the process of reclaiming the VAT you’ve paid on business-related purchases. This can be a significant source of savings for your business, especially if you have a high volume of expenses.

To maximize your VAT recovery, consider the following strategies:

- Keep Detailed Records: Maintain accurate records of all your business expenses, ensuring that you have the necessary documentation to support your VAT recovery claims. This includes invoices, receipts, and any other relevant proof of payment.

- Understand the Rules: Different jurisdictions may have different rules and restrictions around VAT recovery. Ensure you understand these rules and how they apply to your business. This includes knowing which expenses are eligible for VAT recovery and any thresholds or limitations that may apply.

- Utilize Specialist Services: Consider using a specialist VAT recovery service. These services can help you identify and claim back any VAT you're entitled to, ensuring you maximize your recovery and minimize the risk of errors.

Strategic VAT Planning

VAT planning involves making strategic decisions about your business operations and pricing to optimize your VAT position. This can include decisions about which goods or services to sell, how to structure your business, and how to manage your cash flow to minimize VAT costs.

Some key aspects of strategic VAT planning include:

- Margin Analysis: Understand the impact of VAT on your profit margins. This involves analyzing your pricing strategy and considering how changes in VAT rates or structures may impact your business.

- Cash Flow Management: VAT is often paid to the tax authorities on a quarterly or monthly basis. Effective cash flow management can help you ensure you have the necessary funds available to meet these obligations without impacting your business operations.

- Business Structure Optimization: Consider the impact of your business structure on your VAT obligations. Different business structures may have different VAT implications, so it's important to choose the most appropriate structure for your business and ensure it aligns with your VAT planning strategy.

The Future of Online VAT Returns

As technology continues to advance and the digital economy grows, the future of online VAT returns looks set to become even more automated and efficient.

Here are some trends and predictions for the future of online VAT returns:

- Artificial Intelligence (AI) Integration: AI is likely to play an increasingly prominent role in VAT calculations and reporting. AI-powered tools can automate complex VAT processes, ensuring accuracy and efficiency.

- Blockchain Technology: Blockchain has the potential to revolutionize VAT reporting and compliance. It can provide a secure, transparent, and tamper-proof record of transactions, making it easier to track and report VAT obligations.

- Real-Time VAT Reporting: In the future, VAT reporting may move towards real-time submissions. This would involve businesses reporting VAT transactions as they occur, rather than on a periodic basis. This could lead to more accurate reporting and improved cash flow management.

- Global Standardization: While VAT regulations vary significantly between jurisdictions, there may be a move towards greater standardization in the future. This could simplify the process of managing online VAT for businesses operating in multiple markets.

By staying informed about these trends and adapting your online VAT return processes accordingly, you can ensure your business remains compliant and efficient in the years to come.

Conclusion

Maximizing your online VAT returns is not just about compliance; it’s about leveraging the power of technology and strategic planning to optimize your business operations. By understanding the basics, implementing advanced strategies, and keeping an eye on the future, you can ensure your business remains ahead of the curve when it comes to online VAT.

Remember, while this guide provides a comprehensive overview, the specific strategies and tools you choose will depend on the unique needs and circumstances of your business. Stay informed, adapt to changes, and never underestimate the importance of precise, efficient VAT management.

What is the best way to ensure compliance with online VAT regulations?

+To ensure compliance with online VAT regulations, it’s crucial to stay informed about the latest rules and requirements in your jurisdiction. This involves registering for VAT, understanding the applicable tax rates, and maintaining accurate records of all VAT-relevant transactions. Additionally, consider utilizing specialized VAT compliance software or outsourcing to a VAT specialist to help ensure your business remains compliant.

How can technology help optimize my online VAT returns?

+Technology can play a significant role in optimizing your online VAT returns. This includes using software to automatically calculate VAT based on your sales data, generating VAT reports, and integrating with e-commerce platforms. Additionally, data analytics can provide valuable insights to inform your VAT planning and decision-making.

What are some key strategies for maximizing VAT recovery?

+To maximize VAT recovery, it’s essential to keep detailed records of all business expenses and understand the rules and restrictions around VAT recovery in your jurisdiction. Utilizing specialist VAT recovery services can also help ensure you reclaim all the VAT you’re entitled to, maximizing your savings.

How can I stay up-to-date with changes in online VAT regulations and best practices?

+Staying informed about changes in online VAT regulations and best practices is crucial for maintaining compliance and optimizing your VAT returns. This involves regularly reviewing tax authority websites, subscribing to industry newsletters or blogs, and attending relevant webinars or conferences. Additionally, consider joining industry associations or networking groups where you can share information and best practices with other online businesses.