Unraveling the Traditional Income Statement

The traditional income statement, a cornerstone of financial reporting, holds immense value for businesses and investors alike. It provides a comprehensive overview of a company's financial performance, offering insights into its revenue generation, operational efficiency, and profitability. However, despite its widespread use, many are unaware of the intricate details and the full extent of the information it reveals. In this article, we aim to demystify the traditional income statement, exploring its key components, analyzing its structure, and highlighting its critical role in financial decision-making.

Understanding the Anatomy of an Income Statement

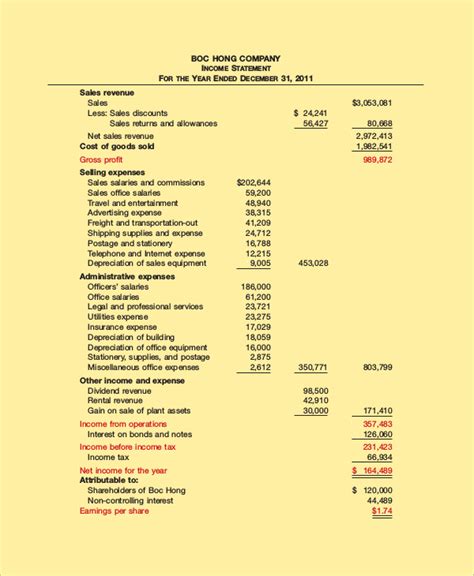

At its core, the traditional income statement is a financial statement that summarizes a company’s revenues and expenses over a specific period. It presents a clear picture of the company’s ability to generate profits, manage costs, and sustain its operations. The statement follows a structured format, typically organized into three main sections: the revenue section, the expense section, and the bottom line.

Revenue Section: The Engine of Growth

The revenue section forms the foundation of the income statement, detailing the various sources of a company’s income. Here, we find critical information such as the company’s total revenue, often categorized into specific product or service lines. For instance, a technology company might break down its revenue into software sales, hardware sales, and professional services. This level of granularity allows stakeholders to understand the relative performance and contribution of each business segment.

Additionally, the revenue section often includes important metrics such as cost of goods sold (COGS) and gross profit. COGS represents the direct costs associated with producing the goods or services sold, while gross profit is the difference between total revenue and COGS. Tracking gross profit margins over time provides valuable insights into a company's pricing strategies, cost structures, and overall financial health.

| Revenue Category | Amount ($) |

|---|---|

| Product Sales | 2,500,000 |

| Service Revenue | 1,800,000 |

| License Fees | 750,000 |

| Total Revenue | 5,050,000 |

Expense Section: Managing Costs for Optimal Performance

The expense section of the income statement provides a detailed breakdown of the various costs incurred by the company during the reporting period. These expenses can be classified into two main categories: operating expenses and non-operating expenses.

Operating expenses, also known as selling, general, and administrative (SG&A) expenses, include costs directly related to the company's core operations. This encompasses salaries and wages, rent, utilities, marketing and advertising expenses, research and development costs, and other overhead expenses. Tracking and managing these expenses is crucial for maintaining operational efficiency and profitability.

Non-operating expenses, on the other hand, encompass costs that are not directly related to the company's core business activities. These may include interest expenses on loans or bonds, impairment charges, and other extraordinary items. While these expenses are typically not under the company's direct control, understanding their impact on the bottom line is essential for a comprehensive financial analysis.

| Expense Category | Amount ($) |

|---|---|

| Salaries and Wages | 1,200,000 |

| Rent and Utilities | 300,000 |

| Marketing and Advertising | 450,000 |

| Research and Development | 250,000 |

| Depreciation and Amortization | 150,000 |

| Total Operating Expenses | 2,350,000 |

| Interest Expenses | 100,000 |

| Other Non-Operating Expenses | 50,000 |

| Total Expenses | 2,500,000 |

The Bottom Line: Gauging Profitability and Performance

The culmination of the income statement lies in the bottom line, which represents the net profit or loss for the reporting period. This figure is calculated by deducting total expenses from total revenue. The bottom line is a critical metric, as it reflects the company’s overall financial performance and its ability to generate profits.

The bottom line can be further segmented into different profitability metrics, providing a more nuanced view of the company's financial health. These metrics include operating profit (also known as earnings before interest and taxes - EBIT), net profit (also known as net income or net earnings), and earnings per share (EPS). Operating profit reflects the company's profitability from core operations, while net profit considers all expenses, including taxes and interest.

| Profitability Metric | Amount ($) |

|---|---|

| Operating Profit (EBIT) | 1,200,000 |

| Net Profit (Net Income) | 800,000 |

| Earnings Per Share (EPS) | 0.40 |

The Role of the Income Statement in Financial Decision-Making

The traditional income statement serves as a powerful tool for financial decision-making, offering insights that guide strategic planning, investment decisions, and operational improvements.

Strategic Planning and Performance Evaluation

For businesses, the income statement is a critical tool for strategic planning and performance evaluation. By analyzing the revenue and expense sections, companies can identify areas of strength and weakness, allowing them to make informed decisions about resource allocation, product development, and market positioning. For instance, if a particular product line consistently generates higher margins, the company might decide to invest more resources into its development and marketing.

Investment Decisions and Risk Assessment

Investors and financial analysts heavily rely on the income statement to assess the financial health and investment potential of a company. The statement provides a snapshot of the company’s profitability, growth prospects, and risk profile. By comparing a company’s income statement with industry averages and competitors, investors can make informed decisions about their investment strategy. For example, a company with consistently growing revenue and improving profit margins might be an attractive investment opportunity.

Operational Efficiency and Cost Control

The income statement also plays a pivotal role in operational decision-making. By tracking expenses and comparing them to industry benchmarks, companies can identify areas where costs can be optimized without compromising quality. This process, known as cost-benefit analysis, helps businesses make informed decisions about resource allocation, outsourcing, and process improvements. For instance, if a company notices a significant increase in marketing expenses without a corresponding rise in revenue, it might reconsider its marketing strategies or explore more cost-effective alternatives.

Conclusion: The Power of Financial Transparency

The traditional income statement is a powerful tool that provides transparency into a company’s financial performance. By understanding its structure, key components, and the insights it offers, stakeholders can make informed decisions that drive business growth and financial success. Whether it’s for strategic planning, investment analysis, or operational efficiency, the income statement serves as a critical compass, guiding businesses and investors toward their financial goals.

As we navigate the complex world of finance, the traditional income statement remains a trusted companion, offering clarity and direction. Its ability to provide a comprehensive view of a company's financial health makes it an indispensable tool for anyone involved in financial decision-making.

What is the purpose of an income statement in financial reporting?

+

The income statement is a financial statement that provides a summary of a company’s financial performance over a specific period. It outlines the company’s revenues, expenses, and profits, offering insights into its financial health and operational efficiency.

How often should a company prepare an income statement?

+

Companies typically prepare income statements on a quarterly and annual basis. Quarterly statements provide a more frequent update on financial performance, while annual statements offer a comprehensive overview of the company’s financial health over a full fiscal year.

What are some key metrics derived from the income statement?

+

Key metrics derived from the income statement include gross profit margin, operating profit margin, net profit margin, and earnings per share (EPS). These metrics provide insights into a company’s profitability, operational efficiency, and overall financial performance.

How can investors use the income statement to evaluate investment opportunities?

+

Investors analyze the income statement to assess a company’s financial health, growth potential, and risk profile. By comparing a company’s financial metrics with industry benchmarks and competitors, investors can make informed decisions about their investment strategy.