Top 5 Pay Schedule Tips

In the realm of human resources and payroll management, having a well-structured pay schedule is essential for maintaining a happy and productive workforce. A pay schedule, also known as a payroll calendar, outlines the specific dates when employees receive their wages or salaries. Creating an effective pay schedule involves careful planning and consideration of various factors. In this expert-level journal article, we will explore the top five pay schedule tips, backed by industry insights and real-world examples, to help you optimize your payroll processes.

1. Understand Legal and Regulatory Requirements

Before designing your pay schedule, it is crucial to have a comprehensive understanding of the legal and regulatory requirements governing payroll practices in your jurisdiction. Employment laws, labor regulations, and tax obligations vary across regions, so it is essential to stay informed and compliant.

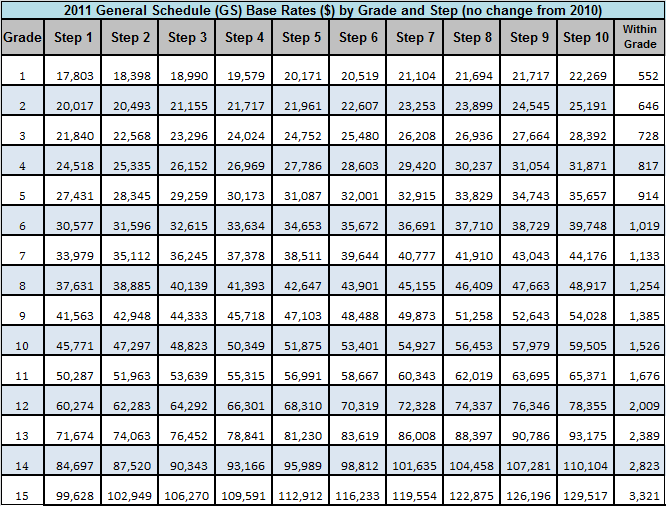

For instance, in the United States, the Fair Labor Standards Act (FLSA) sets minimum wage standards and overtime pay requirements. Employers must ensure that their pay schedules adhere to these regulations. Similarly, in the European Union, the Working Time Directive establishes rules for maximum working hours and rest periods, impacting payroll schedules.

Stay updated on any changes in legislation that may affect your payroll processes. Regularly consult with legal experts or employ specialized payroll software that automatically adjusts to regulatory changes, ensuring your pay schedule remains compliant.

Example: Compliance with the FLSA

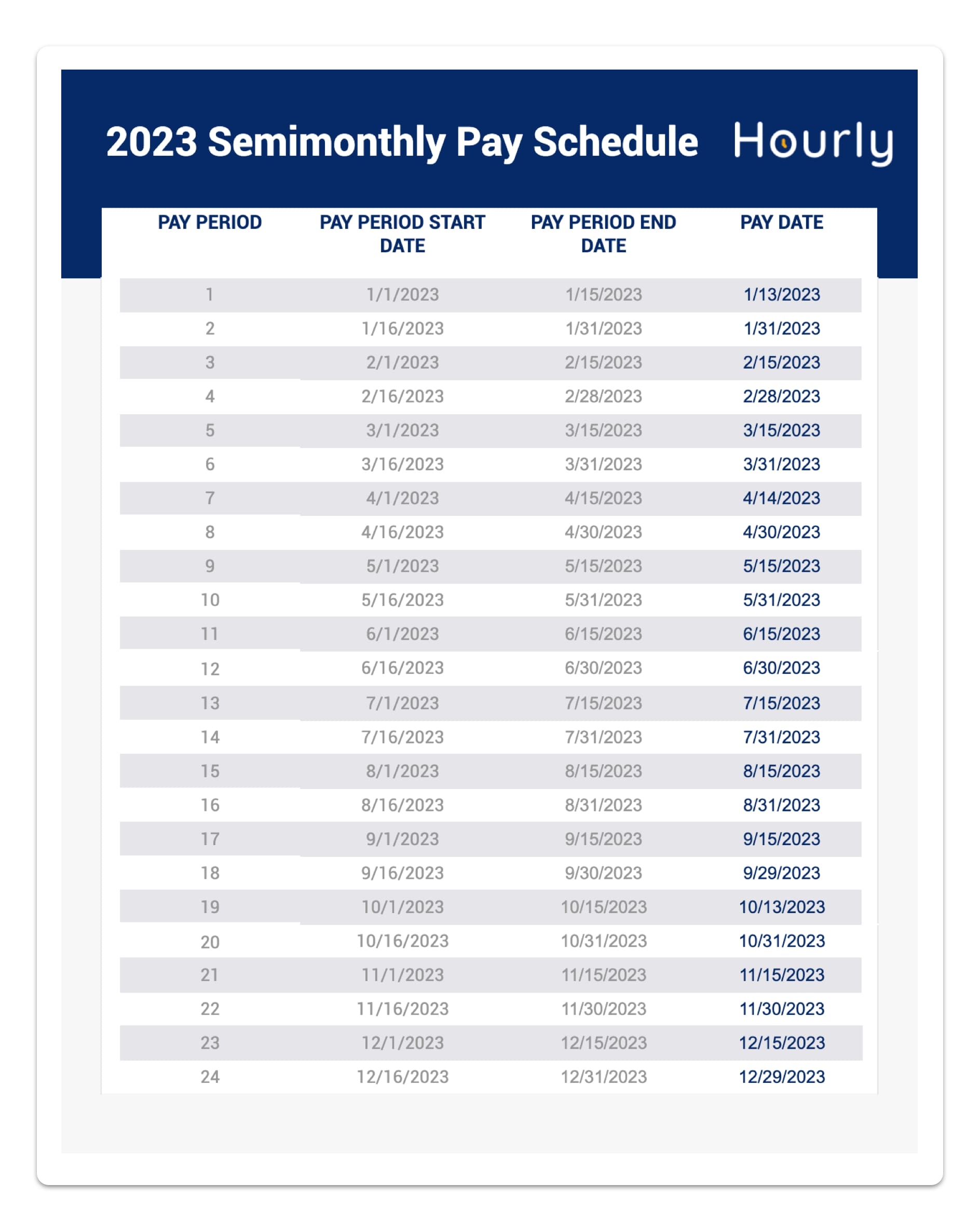

Let’s consider a fictional company, “TechPro Innovations,” based in the United States. TechPro Innovations decides to implement a semi-monthly pay schedule, paying employees on the 15th and last day of each month. However, they must ensure compliance with the FLSA’s overtime pay rules. By thoroughly understanding the FLSA regulations, TechPro Innovations can structure their pay schedule to accurately calculate and compensate employees for overtime hours worked.

2. Choose the Right Pay Frequency

Selecting the appropriate pay frequency is a critical decision that impacts both employees and the organization’s financial management. The most common pay frequencies include weekly, biweekly, semi-monthly, and monthly. Each option has its advantages and considerations.

- Weekly Pay: Weekly pay schedules are ideal for industries with high employee turnover or seasonal variations. They provide frequent cash flow for employees but can be more administratively intensive for payroll teams.

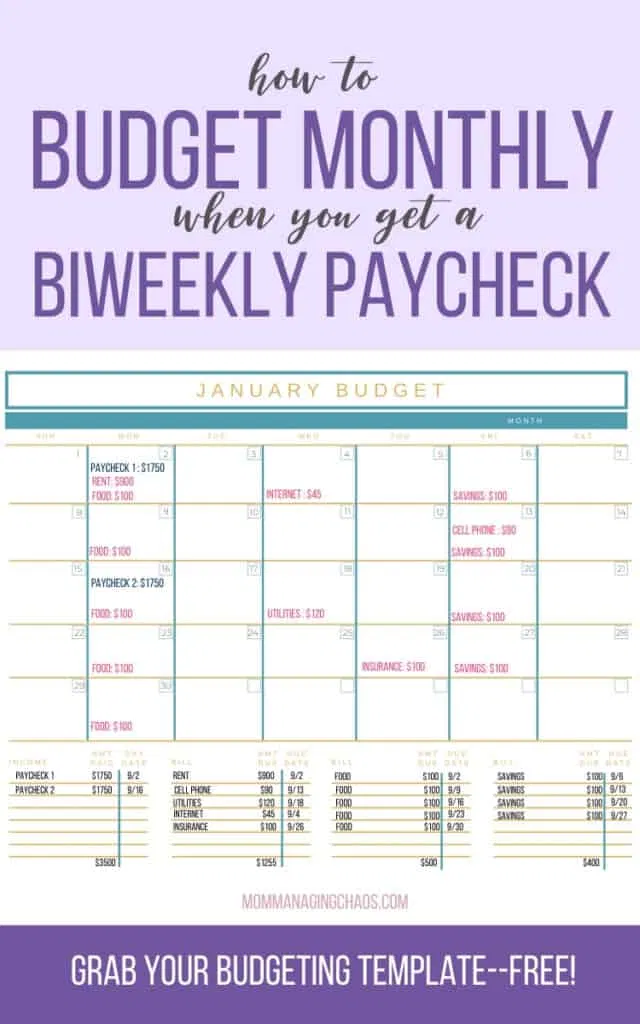

- Biweekly Pay: Biweekly pay, occurring every other week, is a popular choice for many organizations. It strikes a balance between frequent payments and administrative efficiency. Biweekly pay schedules are often favored for their consistency and simplicity.

- Semi-Monthly Pay: Semi-monthly pay schedules involve paying employees twice a month, typically on fixed dates, such as the 15th and the last day of the month. This option offers a more even distribution of pay dates throughout the year.

- Monthly Pay: Monthly pay schedules are common for salaried employees, providing a consistent and stable income. However, they may not suit hourly workers who prefer more frequent payments.

When choosing a pay frequency, consider factors such as industry norms, employee preferences, payroll processing capabilities, and financial considerations. Conduct surveys or gather feedback from employees to understand their payment expectations.

Industry Perspective: Biweekly Pay vs. Semi-Monthly Pay

In the healthcare industry, biweekly pay schedules are often favored due to the nature of shift work and variable hours. Healthcare organizations, like “Medicare Healthcare Services,” find that biweekly pay provides a consistent and predictable payment cycle for their employees. On the other hand, semi-monthly pay schedules are more common in government sectors, where a more even distribution of pay dates is preferred.

3. Maintain Consistency and Timeliness

Consistency and timeliness are vital aspects of an effective pay schedule. Employees rely on receiving their wages or salaries on a predictable and timely basis. Deviations from the established pay schedule can lead to dissatisfaction, confusion, and potential legal issues.

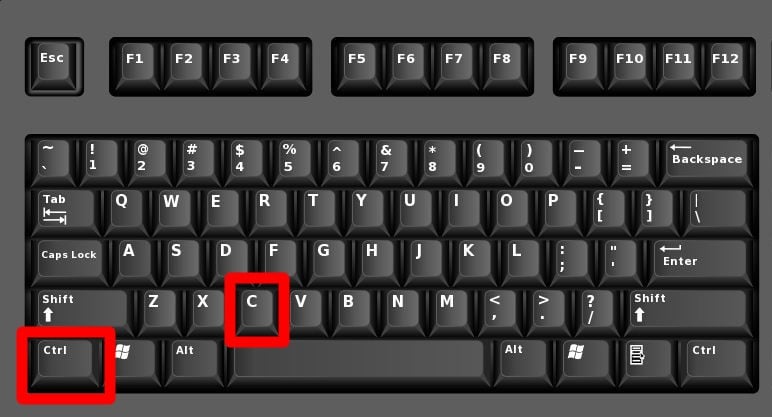

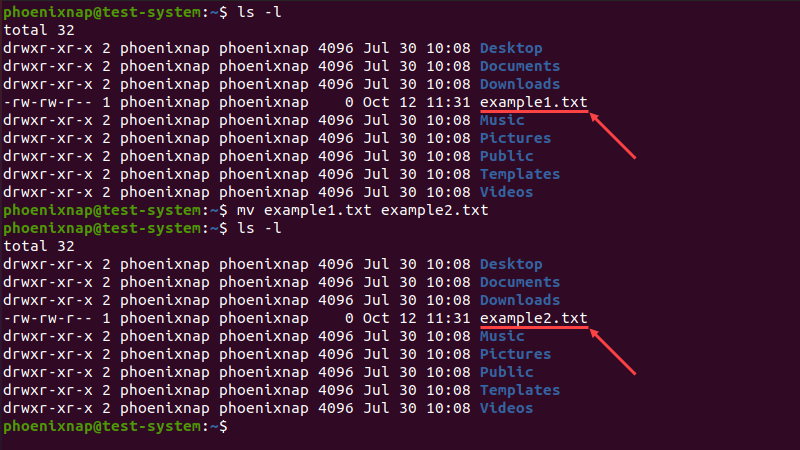

Implementing a robust payroll system that automates payment processes can help ensure consistency. Utilize payroll software that integrates with time tracking systems to accurately calculate wages and generate paychecks or direct deposits on time.

Communicate the pay schedule clearly to all employees, ensuring they understand the payment dates and any potential delays that may occur due to holidays or system updates. Regularly review and update the pay schedule to accommodate changes in pay periods, holidays, or organizational policies.

| Pay Schedule Consistency Tips |

|---|

| Automate payroll processes to minimize human error. |

| Set up reminders and notifications for upcoming pay dates. |

| Establish a backup plan for unexpected delays or system failures. |

| Conduct regular audits to identify and rectify any payment discrepancies. |

Case Study: Pay Schedule Consistency at “RetailPro”

“RetailPro,” a leading retail chain, experienced challenges with pay schedule consistency due to manual payroll processes. By implementing an automated payroll system, they achieved a 99% success rate in meeting pay schedule deadlines, reducing employee complaints and improving overall satisfaction.

4. Accommodate Special Payment Scenarios

Pay schedules should be flexible enough to accommodate various payment scenarios, such as new hires, terminations, leave of absences, and special payments like bonuses or commissions.

- New Hires: Ensure that new employees receive their first paycheck promptly, considering their start date and any backdated payments. Communicate the pay schedule to new hires during the onboarding process.

- Terminations: Develop a process for handling final paychecks for terminated employees, ensuring that all earned wages and benefits are accurately calculated and paid.

- Leave of Absences: Coordinate with the HR department to manage payments for employees on leave, such as maternity or sick leave. Ensure that payroll systems are updated to reflect any changes in payment status.

- Special Payments: Implement a system for processing and distributing special payments like bonuses, commissions, or incentive-based compensation. Communicate these payments clearly to employees, detailing the calculation methods and payment dates.

By accommodating special payment scenarios, organizations can maintain a fair and transparent payroll system, fostering trust and satisfaction among employees.

Example: Handling Bonus Payments at “TechHub”

“TechHub,” a software development company, decides to reward its employees with quarterly performance-based bonuses. To ensure a smooth process, TechHub communicates the bonus payment dates in advance and calculates bonuses based on clearly defined performance metrics. By incorporating special payments into their pay schedule, TechHub motivates its employees and maintains a positive work culture.

5. Utilize Technology for Efficiency and Security

Leveraging technology is essential for optimizing payroll processes and enhancing security. Specialized payroll software and online payment systems offer numerous advantages over manual, paper-based processes.

- Payroll Software: Invest in reliable payroll software that integrates with your existing systems, such as time tracking and HR management tools. Automated payroll systems reduce manual errors, streamline processes, and provide accurate wage calculations.

- Online Payment Systems: Transition from paper checks to direct deposit or online payment systems. Online payments are more secure, convenient, and environmentally friendly. They also reduce the risk of lost or stolen checks.

- Data Security: Ensure that your payroll system meets industry standards for data security. Implement robust access controls, encryption protocols, and regular security audits to protect sensitive employee information.

- Mobile Accessibility: Provide employees with access to their payroll information via mobile-friendly platforms. This enables them to view pay stubs, track hours worked, and access relevant payroll documents remotely.

By embracing technology, organizations can enhance the efficiency and security of their payroll processes, improving the overall employee experience.

Benefits of Technology in Payroll Management

Implementing technology-driven payroll solutions can lead to significant improvements. For instance, a large manufacturing company, “IndustryTech,” experienced a 30% reduction in payroll processing time by transitioning to an automated payroll system. Additionally, the company enhanced data security by implementing multi-factor authentication for payroll access, reducing the risk of unauthorized access to employee records.

How often should I review and update my pay schedule?

+It is recommended to review your pay schedule at least annually to ensure it aligns with regulatory changes and evolving business needs. However, if there are significant changes in your organization’s payroll practices or employee feedback, consider more frequent updates.

Can I offer multiple pay frequencies to accommodate different employee preferences?

+Yes, some organizations offer multiple pay frequencies to cater to diverse employee preferences. However, this approach requires careful planning and coordination to ensure compliance and administrative efficiency. Communicate the available options clearly to employees and provide guidance on choosing the most suitable pay frequency.

How can I handle pay schedule changes during holidays or system updates?

+To handle pay schedule changes during holidays or system updates, it is essential to communicate these changes well in advance to employees. Provide clear information about any adjustments to pay dates and ensure that payroll systems are updated accordingly. Consider implementing a backup plan to address potential delays or issues that may arise during these periods.