Mastering Forecasting: 5 Essential Skills

Welcome to the fascinating world of forecasting, an essential practice across various industries that empowers businesses and professionals to make informed decisions and navigate the future with confidence. Accurate forecasting is a vital tool, allowing organizations to optimize resources, anticipate market trends, and stay ahead of the competition. In this comprehensive guide, we delve into the core skills necessary to excel in forecasting, offering practical insights and real-world examples to enhance your forecasting expertise.

1. Data Analysis and Interpretation

The foundation of effective forecasting lies in the ability to analyze and interpret data accurately. This skill is crucial for identifying patterns, trends, and potential anomalies within a dataset. By employing advanced statistical techniques and data visualization tools, forecasters can gain valuable insights from historical and real-time data.

For instance, consider a retail business aiming to predict sales for the upcoming holiday season. By analyzing past sales data, factoring in seasonal variations, and incorporating external factors like economic indicators, the business can make informed predictions and optimize its inventory and marketing strategies accordingly.

Key techniques in data analysis for forecasting include:

- Time Series Analysis: This method involves examining data points collected over time, helping forecasters identify trends, seasonality, and cyclic patterns.

- Regression Analysis: By establishing relationships between variables, regression analysis enables forecasters to predict future values based on historical data.

- Forecasting Models: Various models, such as ARIMA (Autoregressive Integrated Moving Average) and Exponential Smoothing, can be employed to forecast future outcomes accurately.

Practical Tip: Data Cleaning

Before diving into analysis, ensure your data is clean and free from errors. Outliers and missing values can significantly impact the accuracy of your forecasts. Implement data cleaning techniques to identify and handle such anomalies effectively.

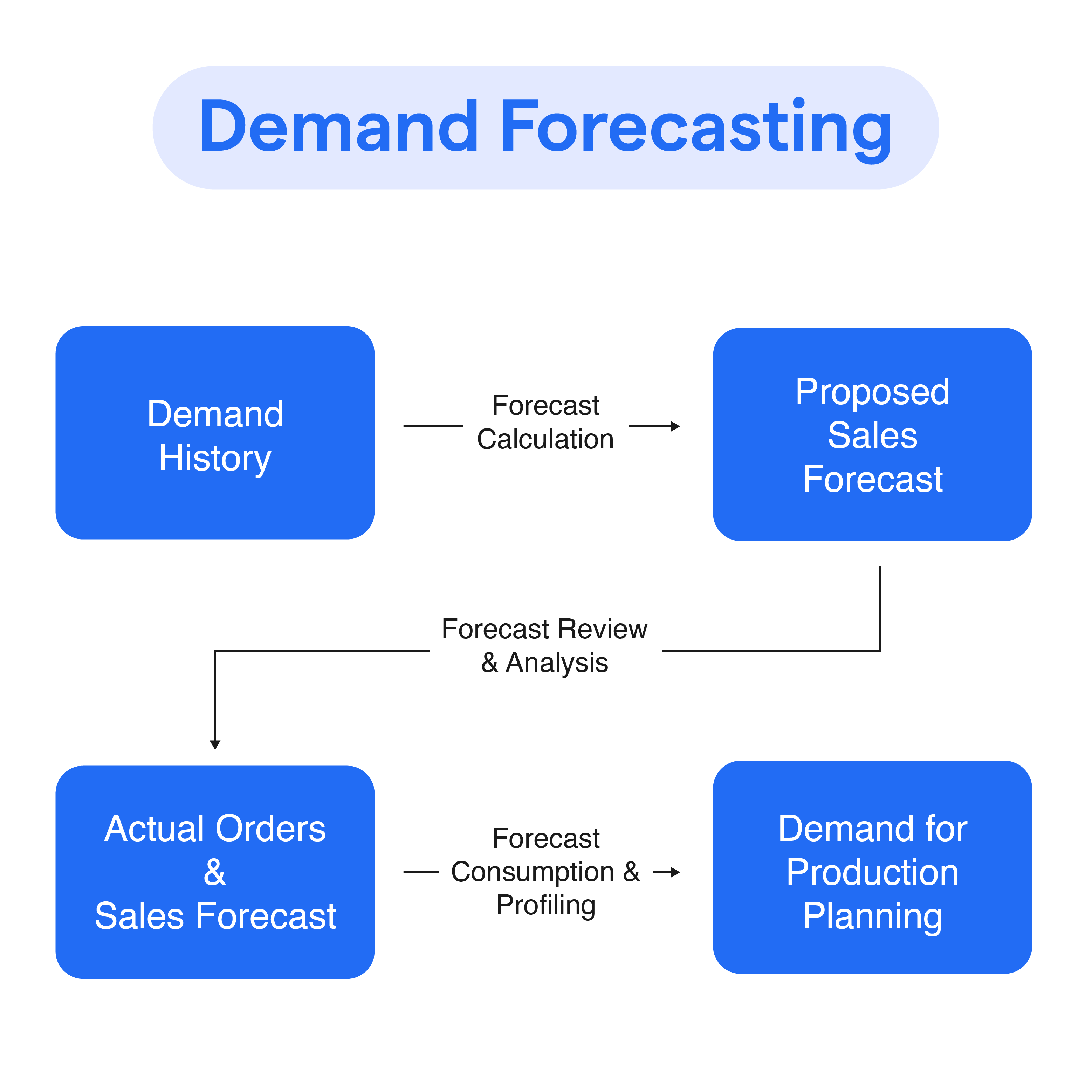

2. Understanding Business Context

Forecasting is not an isolated practice; it is deeply intertwined with the broader business context. A skilled forecaster must possess a thorough understanding of the industry, market dynamics, and the specific business environment they operate in.

Consider a manufacturing company forecasting production levels. Beyond analyzing historical production data, the forecaster should consider factors like supply chain disruptions, labor availability, and market demand fluctuations. By integrating these contextual insights, the company can make more accurate forecasts and adapt its production plans accordingly.

Key considerations for understanding business context include:

- Industry Trends: Stay abreast of industry-specific trends, technological advancements, and regulatory changes that may impact forecasting.

- Competitive Landscape: Analyze competitors’ strategies and market positioning to anticipate potential shifts in demand or supply.

- Market Segmentation: Understand the unique characteristics and behaviors of different customer segments to tailor forecasts and strategies effectively.

Expert Insight: Collaborative Approach

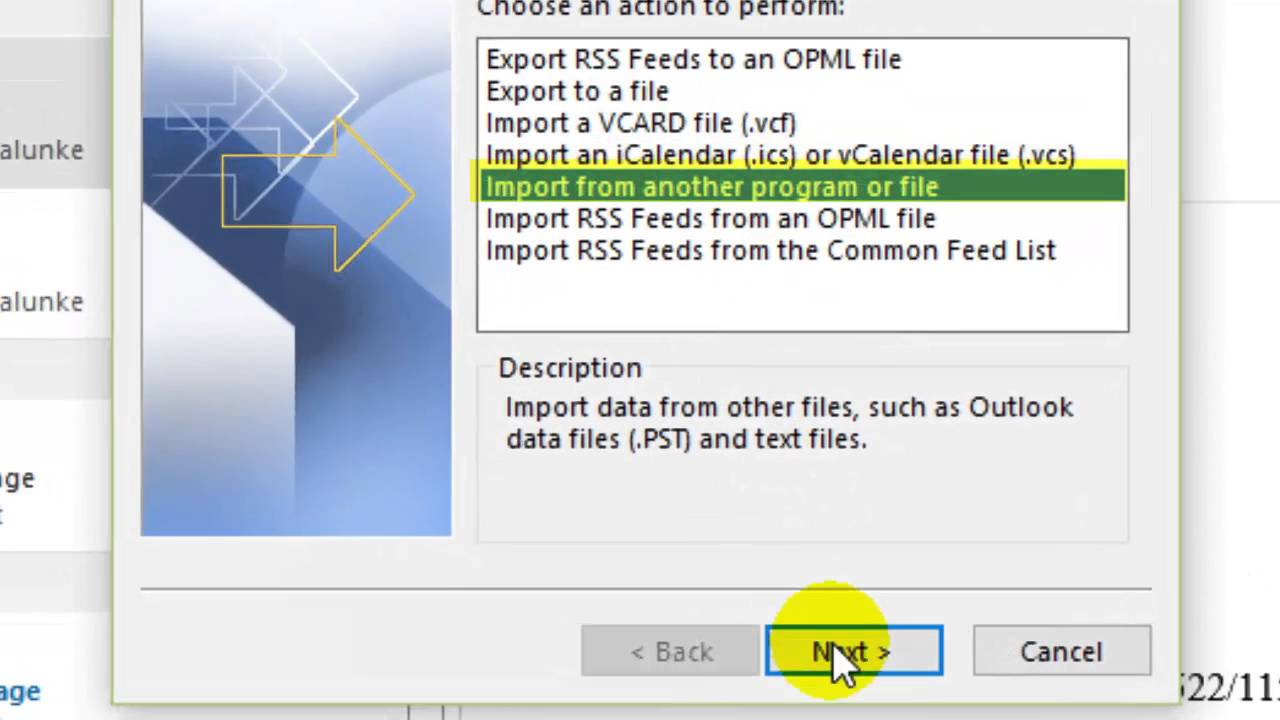

3. Model Selection and Customization

The choice of forecasting model is a critical decision that can significantly impact the accuracy and reliability of your predictions. Different models are suited to different scenarios, and a skilled forecaster should possess the expertise to select and customize models accordingly.

For example, a financial institution forecasting stock prices might employ a combination of models, including ARIMA for short-term predictions and Neural Network models for capturing complex patterns and long-term trends.

Factors to consider when selecting and customizing models include:

- Data Characteristics: Evaluate the nature of your data, including its volume, velocity, and variety, to choose models that can handle these aspects effectively.

- Forecast Horizon: Determine the time frame for which you need predictions. Different models excel at short-, medium-, or long-term forecasts.

- Model Complexity: Balance model complexity with interpretability. Simple models may be easier to understand and communicate, while complex models can capture intricate relationships.

Case Study: Model Hybridization

In certain scenarios, combining multiple models can enhance forecasting accuracy. For instance, a hybrid model combining ARIMA and Machine Learning techniques might be employed to forecast energy demand, capturing both short-term variations and long-term trends.

4. Scenario Planning and Sensitivity Analysis

Forecasting involves dealing with uncertainty, and skilled forecasters must be prepared for various scenarios. Scenario planning allows for the exploration of different outcomes based on varying assumptions and conditions.

Consider a healthcare organization forecasting patient demand. By conducting scenario planning, the organization can develop strategies for various scenarios, such as a sudden increase in cases or changes in healthcare policies. Sensitivity analysis helps identify the key drivers impacting forecasts, enabling organizations to focus on critical variables.

Techniques for scenario planning and sensitivity analysis include:

- Monte Carlo Simulation: This method generates multiple scenarios by incorporating random variables, providing a range of possible outcomes.

- What-If Analysis: By varying specific inputs or assumptions, forecasters can observe the impact on the output, helping to identify critical factors.

- Scenario Comparison: Compare the results of different scenarios to understand the range of potential outcomes and their likelihood.

Real-World Application: Stress Testing

Stress testing is a critical application of scenario planning. Financial institutions, for instance, use stress tests to assess the resilience of their portfolios under extreme market conditions, helping them make informed decisions to mitigate risks.

5. Continuous Learning and Adaptation

The landscape of forecasting is ever-evolving, with new technologies, methodologies, and data sources emerging continuously. A commitment to continuous learning and adaptation is essential for forecasters to stay at the forefront of their field.

Keep abreast of the latest advancements in forecasting techniques, such as the integration of AI and Machine Learning, which are revolutionizing the field. Engage with industry peers, attend conferences and webinars, and explore online resources to expand your knowledge and skill set.

Additionally, foster a culture of learning within your organization. Encourage cross-functional collaboration and knowledge sharing to enhance forecasting capabilities across departments.

Future Trends: AI-Assisted Forecasting

The integration of AI and Machine Learning is poised to revolutionize forecasting, offering unprecedented accuracy and efficiency. AI-assisted forecasting can automate repetitive tasks, identify complex patterns, and provide real-time insights, empowering organizations to make data-driven decisions with confidence.

Conclusion

Mastering the art of forecasting is a journey that requires a combination of technical prowess, business acumen, and a commitment to continuous learning. By honing your skills in data analysis, understanding business context, selecting appropriate models, conducting scenario planning, and embracing ongoing learning, you can become a formidable forecaster, driving your organization’s success in an uncertain future.

What are some common challenges in forecasting, and how can they be addressed?

+Forecasting comes with its set of challenges, including data quality issues, changing market dynamics, and the need for accurate model selection. To address these, ensure data integrity through thorough cleaning and validation. Stay updated with industry trends and market shifts to incorporate relevant factors into your forecasts. Additionally, collaborate with experts from different domains to gain diverse perspectives and enhance the accuracy of your models.

How can I communicate the results of my forecasts effectively to stakeholders?

+Effective communication is key to ensuring your forecasts are understood and acted upon. Use clear and concise language, avoiding technical jargon. Visualize your data with charts and graphs to make complex trends more accessible. Provide context and explain the assumptions and methodologies behind your forecasts. Engage in open dialogue with stakeholders to address their concerns and ensure alignment with organizational goals.

What are some best practices for forecasting in highly volatile industries or markets?

+In volatile environments, it’s crucial to adopt a flexible approach. Continuously monitor market conditions and be prepared to adjust your forecasts accordingly. Employ scenario planning to anticipate various outcomes and develop contingency strategies. Stay informed about industry-specific factors and external influences that may impact your forecasts. Additionally, consider using ensemble models that combine multiple forecasting techniques to improve accuracy.