Tax Preparation: A Comprehensive Guide

Tax season is a crucial period for individuals and businesses alike, and effective tax preparation is essential to ensure compliance, optimize deductions, and manage financial obligations. This comprehensive guide aims to provide an in-depth understanding of tax preparation, offering valuable insights and strategies to navigate the process efficiently.

Understanding the Fundamentals of Tax Preparation

Tax preparation is a systematic process that involves gathering, organizing, and analyzing financial information to accurately determine tax liabilities. It encompasses a range of activities, from collecting necessary documents and records to calculating taxable income, identifying deductions and credits, and ultimately filing tax returns.

The complexity of tax preparation varies depending on individual circumstances, such as employment status, income sources, investments, and business ownership. Understanding the fundamental principles and key concepts is vital to ensure a smooth and accurate tax filing process.

Gathering Essential Documents

The first step in tax preparation is to gather all relevant documents and records. These may include pay stubs, W-2 forms, 1099 forms, expense receipts, investment statements, and any other records related to income, deductions, and credits. Organizing these documents systematically can simplify the tax preparation process and help identify potential deductions.

| Document Type | Description |

|---|---|

| W-2 Forms | Records of wages, tips, and other compensation from employers. |

| 1099 Forms | Reports of various types of income, including freelance work, interest, and dividends. |

| Expense Receipts | Records of expenses that may qualify for deductions, such as business expenses, medical costs, and charitable donations. |

| Investment Statements | Details of income and capital gains/losses from investments, including stocks, bonds, and mutual funds. |

Tip: Utilize digital tools and apps to scan and organize your tax-related documents. This not only streamlines the process but also ensures easy access and backup in case of emergencies.

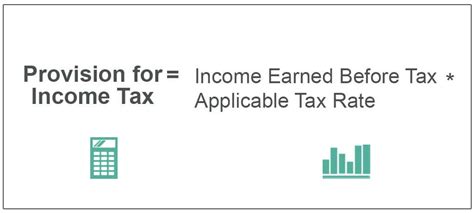

Calculating Taxable Income and Deductions

The next step is to calculate taxable income and identify eligible deductions. Taxable income is the amount of income subject to taxation, and it varies based on factors such as filing status, deductions, and credits.

Deductions reduce taxable income and can significantly impact the amount of tax owed. Common deductions include mortgage interest, state and local taxes, medical expenses, charitable contributions, and certain business expenses. Understanding which deductions apply to your specific situation is crucial for optimizing your tax liability.

Understanding Tax Credits

Tax credits are a valuable tool that can reduce the amount of tax owed or increase the size of your refund. Unlike deductions, which reduce taxable income, credits directly reduce the amount of tax owed. There are various types of tax credits, including the Child Tax Credit, Education Credits, and the Earned Income Tax Credit.

Researching and understanding the eligibility criteria for tax credits can help maximize your tax benefits. It's important to note that some credits are non-refundable, meaning they can only reduce your tax liability to zero, while others are refundable, allowing you to receive a refund even if you have no tax liability.

Strategies for Effective Tax Preparation

Effective tax preparation requires a strategic approach to ensure accuracy, efficiency, and optimal tax benefits. Here are some strategies to consider:

Stay Informed on Tax Laws and Updates

Tax laws and regulations can change frequently, so it’s essential to stay informed on the latest updates. This includes keeping up with changes in tax rates, deductions, and credits, as well as understanding any new tax incentives or programs introduced by the government.

Subscribing to reputable tax-related websites, following industry news, and consulting with tax professionals can help ensure you are aware of the most recent tax law changes and their implications.

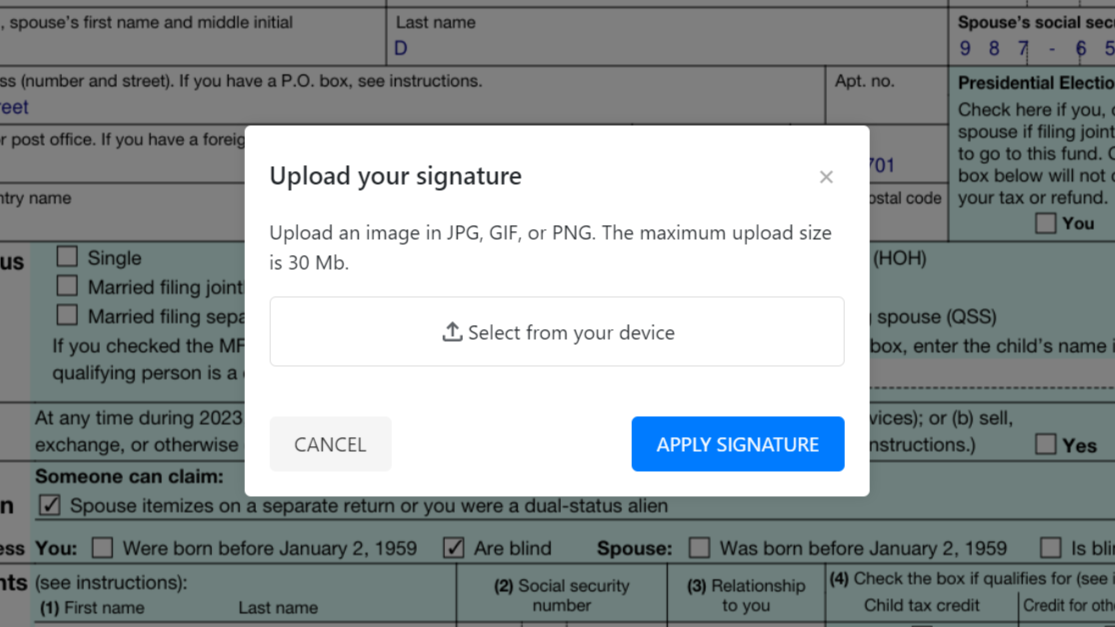

Utilize Tax Preparation Software

Tax preparation software has revolutionized the way individuals and businesses file their taxes. These programs guide users through the tax preparation process, providing step-by-step instructions and calculating taxes based on the information entered.

Tax preparation software can help simplify complex tax scenarios, ensure accuracy, and identify potential deductions and credits. It also offers the convenience of online filing, allowing taxpayers to submit their returns electronically.

Seek Professional Tax Advice

While tax preparation software is a valuable tool, complex tax situations or unique circumstances may require professional tax advice. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are highly trained tax professionals who can provide expert guidance and assistance.

Tax professionals can help navigate complex tax laws, optimize deductions and credits, and ensure compliance with tax regulations. They can also assist with tax planning strategies to minimize future tax liabilities and maximize tax benefits.

Plan for Tax Payments and Refunds

Effective tax preparation involves not only calculating taxes but also planning for tax payments and managing refunds. If you expect to owe taxes, consider setting aside funds throughout the year to cover your tax liability. This can help avoid penalties and interest charges associated with late payments.

On the other hand, if you anticipate a tax refund, you can use tax preparation tools to estimate the amount you may receive. This information can be useful for financial planning and budgeting purposes.

Tax Preparation for Different Income Sources

Tax preparation strategies may vary depending on the type of income and the associated tax implications. Here’s a breakdown of tax preparation considerations for different income sources:

Wage and Salary Income

For individuals with wage and salary income, tax preparation primarily involves gathering W-2 forms, tracking deductions, and understanding tax withholding. Reviewing pay stubs throughout the year can help identify any discrepancies or adjustments needed for tax filing.

Self-Employment Income

Self-employed individuals face unique tax challenges, including the need to pay self-employment taxes and estimate quarterly tax payments. Tax preparation for self-employed individuals involves tracking business income and expenses, calculating self-employment tax, and claiming applicable business deductions.

Investment Income

Tax preparation for investment income requires careful tracking of capital gains, dividends, and interest income. Understanding the tax implications of different types of investments, such as stocks, bonds, and real estate, is crucial for accurate tax reporting.

Rental Property Income

Rental property owners must report rental income and expenses on their tax returns. Tax preparation for rental properties involves tracking rental income, deducting expenses such as maintenance, repairs, and property taxes, and understanding the depreciation rules for rental properties.

Tax Preparation for Businesses

Tax preparation for businesses involves a more complex process, often requiring the expertise of a tax professional. Here are some key considerations for business tax preparation:

Choosing the Right Business Structure

The choice of business structure, such as sole proprietorship, partnership, corporation, or limited liability company (LLC), has significant tax implications. Each structure offers different tax advantages and disadvantages, so it’s important to choose the structure that aligns with your business goals and tax obligations.

Business Income and Expenses

Business tax preparation involves tracking business income and expenses to determine taxable income. Businesses must carefully document and categorize expenses to ensure they qualify for deductions and to support tax filings.

Quarterly Tax Payments

Businesses often need to make estimated tax payments throughout the year to cover their tax liability. Failure to make these payments can result in penalties and interest charges. Tax preparation for businesses should include a strategy for estimating and paying quarterly taxes.

Business Tax Credits and Incentives

Businesses may be eligible for various tax credits and incentives, such as the Research and Development Tax Credit, Energy Efficiency Credits, and the Work Opportunity Tax Credit. Understanding these incentives and their eligibility criteria can help businesses maximize their tax benefits.

Future Trends in Tax Preparation

The field of tax preparation is continually evolving, and several trends are shaping the future of tax filing:

Digital Transformation

The tax industry is experiencing a digital transformation, with an increasing focus on online tax preparation and filing. Taxpayers can now utilize digital tools and platforms to prepare and file their taxes, offering convenience, efficiency, and cost savings.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are being leveraged to improve tax preparation accuracy and efficiency. These technologies can analyze large volumes of data, identify potential deductions and credits, and provide personalized tax recommendations.

Blockchain and Cryptocurrency

The rise of blockchain technology and cryptocurrency has introduced new complexities to tax preparation. Tax professionals are adapting to these changes, offering guidance on the tax implications of cryptocurrency transactions and ensuring compliance with evolving tax regulations.

Tax Planning and Strategy

There is a growing emphasis on tax planning and strategy as taxpayers seek to optimize their tax positions and minimize liabilities. Tax professionals are increasingly providing proactive tax planning services to help individuals and businesses make informed financial decisions with tax implications in mind.

Conclusion

Tax preparation is a critical process that requires careful planning, organization, and a solid understanding of tax laws and regulations. By gathering essential documents, calculating taxable income and deductions, and utilizing effective strategies, individuals and businesses can navigate the tax landscape with confidence.

Whether you're a taxpayer or a business owner, staying informed, utilizing technology, and seeking professional advice can help ensure accurate tax preparation and compliance. Remember, effective tax preparation is not just about meeting obligations; it's also about optimizing your financial position and maximizing tax benefits.

What are some common mistakes to avoid during tax preparation?

+Common mistakes include failing to report all sources of income, overlooking deductions and credits, not keeping proper records, and missing filing deadlines. It’s important to carefully review your tax returns and seek professional help if needed to avoid these pitfalls.

How can I stay up-to-date with tax law changes?

+You can stay informed by subscribing to reputable tax websites, following tax-related news and blogs, and consulting with tax professionals. Many tax preparation software providers also offer updates and notifications regarding tax law changes.

What is the best way to choose a tax preparation software?

+Consider your specific tax situation and needs. Evaluate software features, user reviews, and pricing. Look for software that offers guidance, supports your income sources and deductions, and provides a seamless filing process. You may also benefit from consulting with a tax professional to determine the best software for your circumstances.

How can I estimate my tax refund or liability?

+Tax preparation software often provides tools to estimate your refund or liability based on the information you enter. These estimates can help you plan your finances accordingly. However, it’s important to note that actual refunds or liabilities may vary based on factors such as deductions, credits, and tax law changes.