Unveiling the Default Probability Formula

In the world of risk analysis and credit scoring, the concept of default probability is a crucial metric used by financial institutions and businesses to assess the likelihood of borrowers failing to repay their debts. This metric plays a pivotal role in decision-making processes, influencing lending policies and risk management strategies. Unveiling the intricacies of the default probability formula is essential for gaining a comprehensive understanding of this critical aspect of financial analysis.

The default probability formula serves as a mathematical tool to quantify the risk associated with lending. It provides a systematic approach to estimating the probability of a borrower defaulting on their financial obligations. By considering various factors and variables, this formula allows financial analysts and experts to make informed decisions, mitigate risks, and optimize lending practices.

Understanding the Default Probability Formula

The default probability formula is a sophisticated mathematical equation that takes into account multiple variables and factors to calculate the likelihood of a borrower defaulting. It is a complex model that requires a deep understanding of statistical concepts and financial analysis techniques.

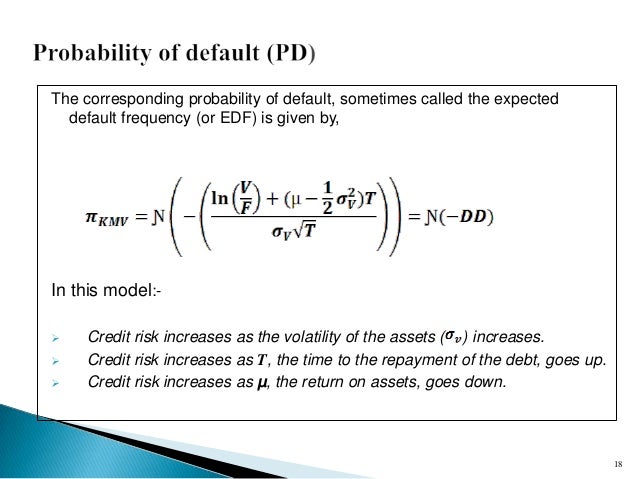

The general form of the default probability formula can be expressed as follows:

Default Probability = f(Borrower's Credit Score, Financial History, Economic Factors, Industry Trends, etc.)

In this formula, the function f represents a complex mathematical relationship that maps the input variables to a probability value. Each of these variables plays a crucial role in determining the default probability.

Key Variables in the Formula

The default probability formula considers a wide range of variables, each contributing to the overall risk assessment. Here are some of the key factors that influence the formula:

- Borrower's Credit Score: The credit score of the borrower is a critical indicator of their creditworthiness. It reflects their past repayment behavior and financial reliability. A higher credit score generally indicates a lower default risk.

- Financial History: The borrower's financial history, including their income, employment status, and past debts, provides insights into their ability to manage finances and repay loans. A stable financial history suggests a lower probability of default.

- Economic Factors: Macroeconomic conditions, such as interest rates, inflation, and economic growth, can significantly impact default probabilities. Adverse economic conditions may increase the risk of default.

- Industry Trends: The performance and trends within the industry or sector in which the borrower operates can affect their ability to repay. Industries facing challenges may increase the risk of default for borrowers within that sector.

- Collateral: In secured loans, the presence and value of collateral play a role in reducing default risk. Collateral provides an additional layer of security for lenders, making it a key consideration in the formula.

- Lender's Internal Data: Financial institutions often have their own internal data and proprietary models to assess default risk. This data, which may include historical default rates and risk scores, contributes to the accuracy of the formula.

These variables are just a few examples of the many factors that influence the default probability formula. The complexity of the formula lies in its ability to capture and weigh these variables to provide a comprehensive risk assessment.

Applications of Default Probability

The default probability formula finds extensive applications in various financial and risk management scenarios. Its importance and utility are evident in the following areas:

Credit Scoring and Lending Decisions

The primary application of the default probability formula is in credit scoring and lending decisions. Financial institutions use this formula to assess the creditworthiness of potential borrowers. By calculating the default probability, lenders can determine appropriate interest rates, loan terms, and credit limits for each borrower, ensuring a balanced approach between risk and profitability.

For instance, a borrower with a high default probability may be offered a loan with stricter terms, higher interest rates, or additional collateral requirements to mitigate the risk. On the other hand, borrowers with a low default probability may enjoy more favorable lending conditions.

Risk Management and Portfolio Analysis

Default probability analysis is a crucial tool for risk managers in financial institutions. By calculating and monitoring default probabilities, risk managers can identify potential problem areas within their loan portfolios. They can proactively take measures to reduce risk, such as implementing stricter lending criteria or diversifying their loan portfolios to mitigate concentration risk.

Additionally, default probability analysis helps risk managers allocate resources effectively. They can prioritize monitoring and intervention for loans with higher default probabilities, ensuring timely action to minimize losses.

Economic Forecasting and Policy Making

Default probability data and analysis play a significant role in economic forecasting and policy formulation. Central banks and regulatory authorities use this information to understand the overall health of the financial system and the economy. By monitoring default probabilities across different sectors and regions, policymakers can make informed decisions regarding monetary policy, regulatory interventions, and economic stimulus measures.

For example, if default probabilities rise significantly in a particular industry, policymakers may consider targeted support measures to prevent a widespread default crisis.

Performance Analysis and Validation

The accuracy and performance of the default probability formula are critical to its effectiveness. Financial institutions and analysts employ various methods to validate and refine the formula, ensuring its reliability and relevance.

Historical Data Analysis

One of the primary methods of validating the default probability formula is by analyzing its performance using historical data. Financial institutions compare the predicted default probabilities with actual default rates to assess the formula’s accuracy. By studying the discrepancies between predicted and actual outcomes, analysts can refine the formula and improve its predictive power.

For instance, if the formula consistently underestimates default probabilities for a particular segment of borrowers, adjustments can be made to the model to enhance its accuracy.

Sensitivity Analysis

Sensitivity analysis is another powerful tool used to understand the impact of changes in input variables on the default probability. By varying the values of key variables, analysts can observe how the formula responds and identify the most influential factors. This analysis helps in fine-tuning the formula and understanding the critical drivers of default risk.

Peer Comparison and Benchmarking

Financial institutions often compare their default probability models with those of their peers in the industry. Benchmarking against industry standards helps identify areas for improvement and ensures that the formula remains competitive and effective in a dynamic market.

Future Implications and Innovations

As the financial landscape evolves, the default probability formula continues to adapt and innovate. Here are some future implications and potential advancements in this field:

Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) techniques is revolutionizing default probability analysis. AI-powered models can process vast amounts of data, identify complex patterns, and make more accurate predictions. ML algorithms can continuously learn and improve as they are exposed to new data, enhancing the accuracy and adaptability of the formula.

Big Data and Alternative Data Sources

The availability of big data and alternative data sources presents new opportunities for enhancing default probability models. By incorporating non-traditional data, such as social media activity, online behavior, and satellite imagery, analysts can gain deeper insights into borrowers’ financial health and behavior. This expanded data set can lead to more comprehensive and accurate risk assessments.

Regulatory and Ethical Considerations

As default probability analysis becomes more sophisticated, regulatory bodies and ethical committees play a crucial role in ensuring responsible and unbiased use of this powerful tool. They establish guidelines and standards to prevent discrimination and ensure fairness in lending practices. Striking a balance between risk assessment and ethical considerations is an ongoing challenge in the industry.

Conclusion

The default probability formula is a cornerstone of financial risk analysis, providing a systematic approach to assessing the likelihood of borrower default. Its applications span across lending decisions, risk management, economic forecasting, and policy making. As the financial landscape evolves, so too does the formula, incorporating advancements in technology and data analytics.

By understanding the intricacies of the default probability formula, financial institutions can make informed decisions, mitigate risks, and contribute to the stability and growth of the global financial system. This comprehensive guide has unveiled the formula's complexities, applications, and future directions, shedding light on its vital role in the world of finance.

How accurate is the default probability formula in predicting borrower defaults?

+The accuracy of the default probability formula depends on various factors, including the quality of data, the sophistication of the model, and the specific industry and borrower segment being analyzed. While it provides a valuable risk assessment tool, it is not infallible. Historical data analysis and ongoing refinement are essential to enhance its accuracy over time.

Can the default probability formula be customized for specific industries or sectors?

+Yes, the default probability formula can be tailored to specific industries or sectors. Financial institutions often develop industry-specific models that take into account unique factors and trends within that sector. Customization allows for more accurate risk assessments tailored to the specific challenges and opportunities of different industries.

What are the potential ethical concerns associated with default probability analysis?

+Default probability analysis raises ethical concerns related to fairness, discrimination, and privacy. It is crucial to ensure that the formula does not inadvertently discriminate against certain borrower segments or infringe on privacy rights. Regulatory bodies and ethical committees play a vital role in establishing guidelines to address these concerns and promote responsible lending practices.