4 Tips to Select Payroll Check Printing Software

Choosing the right payroll check printing software is crucial for businesses to streamline their payroll processes, ensure compliance with regulations, and provide accurate and timely compensation to employees. With numerous options available in the market, it can be challenging to identify the most suitable software for your specific needs. In this article, we will guide you through four essential tips to help you select the best payroll check printing software for your business.

1. Assess Your Business Requirements

Before diving into the world of payroll check printing software, take a step back and thoroughly assess your business’s unique requirements. Understand the size of your organization, the number of employees, and the complexity of your payroll processes. Consider the following factors:

- Employee Data Management: Evaluate how the software handles employee information, including personal details, tax information, and pay rates. Ensure it can efficiently manage and secure sensitive data.

- Payroll Frequency: Determine the frequency of your payroll runs (weekly, biweekly, monthly) and whether the software can accommodate these cycles without any complications.

- Compliance and Regulations: Stay compliant with local, state, and federal regulations regarding payroll and taxation. Choose software that automatically calculates and withholds taxes, offers guidance on compliance, and generates necessary reports.

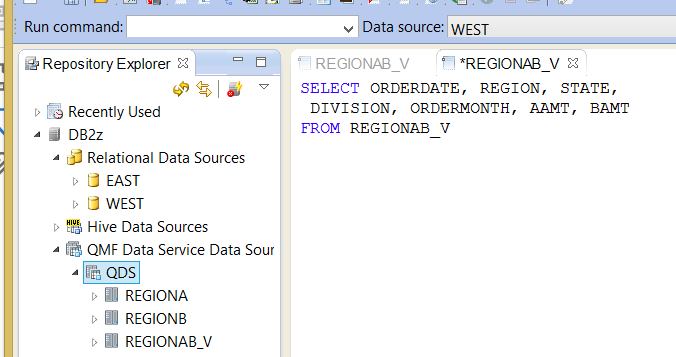

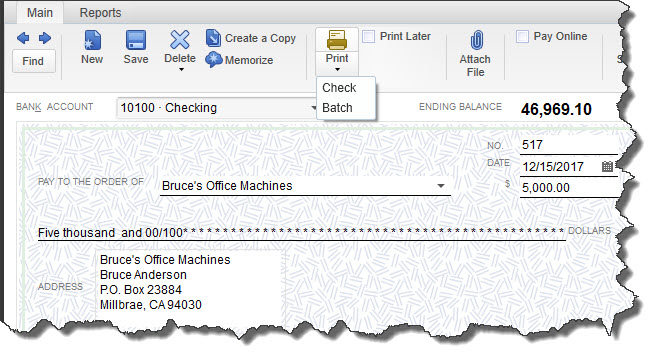

- Integration with Existing Systems: If you already have HR or accounting software in place, integration is key. Look for payroll check printing software that seamlessly integrates with your existing systems to avoid data duplication and streamline workflows.

- User-Friendliness: Consider the technical proficiency of your staff. Opt for software with an intuitive interface and user-friendly navigation to minimize training time and potential errors.

Real-World Example: Small Business Solutions

For a small business with 20 employees, a user-friendly payroll check printing software like Payroll Pro could be an excellent choice. It offers a simple interface, automatic tax calculations, and seamless integration with popular accounting software. With its intuitive design, even employees with limited technical knowledge can efficiently manage payroll tasks.

2. Evaluate Software Features and Functionality

Once you have a clear understanding of your business needs, it’s time to delve into the features and functionality of the payroll check printing software options available. Look for software that offers a comprehensive set of features to meet your current and future requirements.

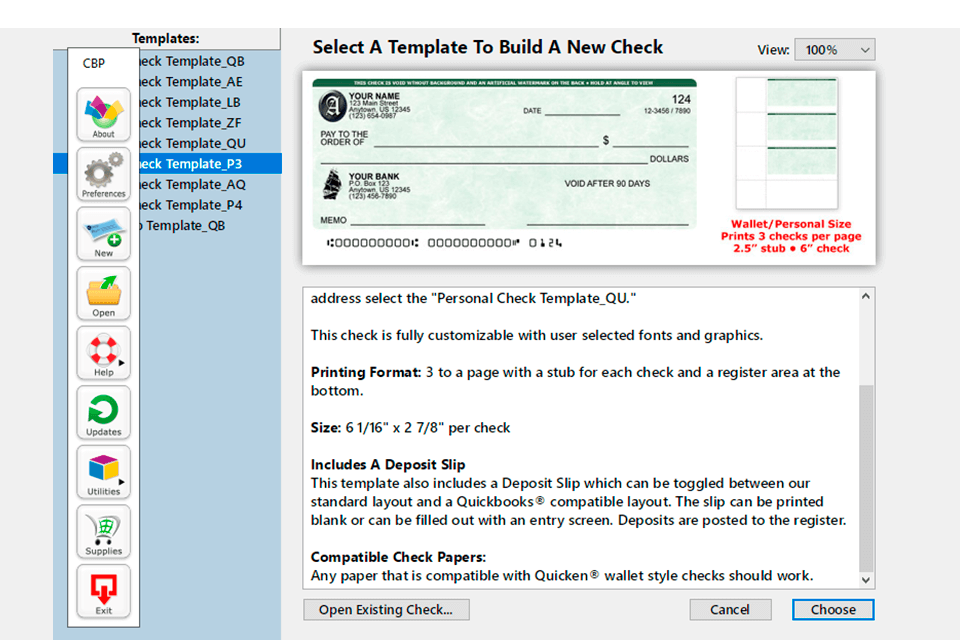

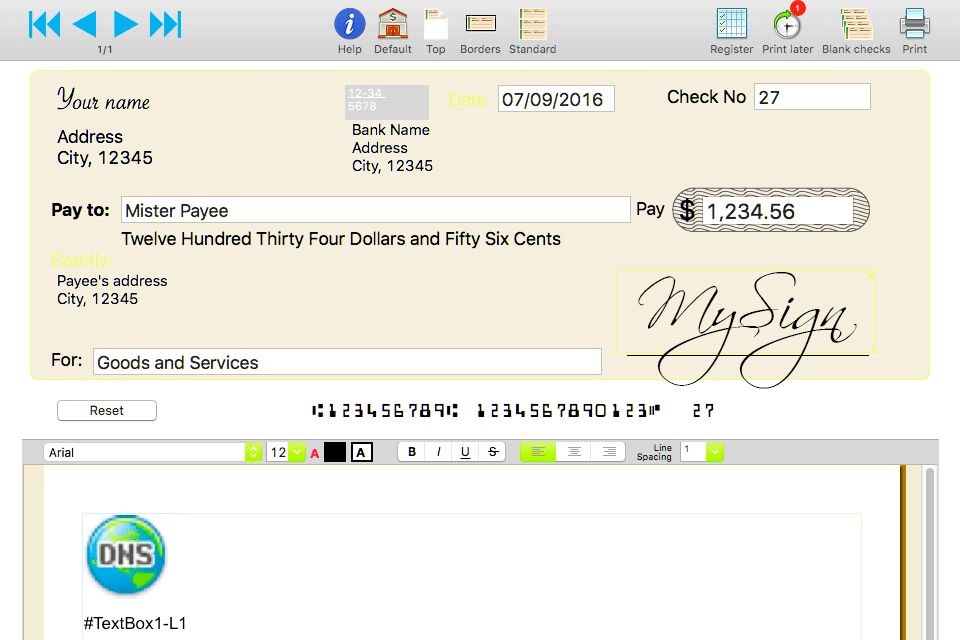

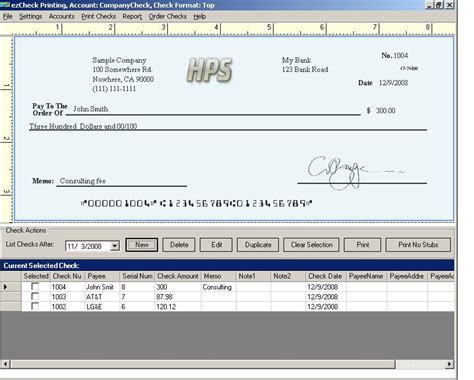

- Check Printing: Ensure the software provides professional-looking check designs with customizable options for logos, signatures, and pay stubs. Some software even offers pre-designed check templates for a quick setup.

- Payroll Calculations: The software should accurately calculate employee earnings, deductions, and net pay. It should also handle various pay types, such as salaries, hourly wages, commissions, and bonuses.

- Reporting and Analytics: Generate detailed reports on payroll activities, tax liabilities, and employee compensation. Advanced analytics features can provide insights to optimize your payroll processes and identify potential cost-saving opportunities.

- Security and Data Protection: Prioritize software with robust security measures to protect sensitive employee data. Look for features like multi-factor authentication, encryption, and role-based access control to ensure data privacy and compliance with regulations like GDPR or CCPA.

- Mobile Accessibility: In today’s fast-paced business environment, mobile accessibility is crucial. Choose software that offers a mobile app or web-based access, allowing employees to view pay stubs, update personal information, and access relevant payroll documents on the go.

Industry Comparison: Large Enterprise vs. Startup

A large enterprise with a diverse workforce might benefit from a feature-rich payroll check printing software like PayrollX. This software offers advanced reporting capabilities, robust security features, and the ability to handle complex payroll scenarios. On the other hand, a startup with a lean team might prefer a cost-effective solution like SimplePay, which provides essential payroll features, easy setup, and seamless mobile accessibility.

3. Consider Scalability and Flexibility

Your business may experience growth or changes in its operational structure over time. Therefore, it’s crucial to select payroll check printing software that can scale with your business’s evolving needs. Consider the following factors regarding scalability and flexibility:

- User Management: Ensure the software allows for easy addition and removal of users as your workforce expands or contracts. Efficient user management simplifies the process of onboarding new employees and maintaining an accurate payroll database.

- Payroll Cycle Flexibility: Choose software that accommodates varying payroll cycles. As your business grows, you may need to adjust payroll frequencies or accommodate different pay cycles for specific employee groups. The software should be adaptable to these changes.

- Data Storage and Retention: Understand the software’s data storage capabilities and retention policies. Ensure it can handle increased data volume as your employee base grows and that it complies with legal requirements for data retention and disposal.

- Customizability: Look for software that allows customization to align with your business’s specific needs. This includes the ability to create custom reports, tailor employee communication, and personalize the overall user experience.

| Software | Scalability Features |

|---|---|

| Payroll Pro | Dynamic user management, customizable payroll cycles, and scalable data storage. |

| PayrollX | Robust user management system, flexible payroll cycle configurations, and advanced data retention policies. |

| SimplePay | Efficient user onboarding, customizable payroll templates, and scalable data storage options. |

4. Customer Support and Training

Even with the most user-friendly software, there may be instances where you require assistance or training. Ensure the payroll check printing software provider offers reliable customer support and comprehensive training resources.

- Customer Support Channels: Look for multiple support channels, including phone, email, live chat, and online ticketing systems. The ability to connect with a knowledgeable support team can be crucial during urgent payroll matters.

- Response Time: Understand the software provider’s response time commitments. Prompt support is essential to address any issues or queries efficiently.

- Training Resources: Access to comprehensive training materials, tutorials, and webinars can significantly expedite the onboarding process for new users. Ensure the software provider offers these resources to help your team quickly become proficient in using the software.

- Community Support: Some software providers offer community forums or knowledge bases where users can interact, share tips, and resolve common issues. This can be a valuable resource for ongoing support and learning.

Expert Tip: Go Beyond Basic Support

Conclusion: Making an Informed Decision

Selecting the right payroll check printing software is a strategic decision that can significantly impact your business’s efficiency and compliance. By following these four tips and conducting thorough research, you can choose a solution that aligns with your current and future payroll needs. Remember, the software should streamline your payroll processes, enhance productivity, and provide an excellent employee experience.

Frequently Asked Questions

What is the average cost of payroll check printing software?

+

The cost of payroll check printing software varies widely depending on the features, scalability, and support offered. Basic plans can start as low as $20 per month, while more advanced solutions may cost several hundred dollars per month. It’s essential to evaluate your specific needs and budget to choose the right option.

Can I use payroll check printing software for direct deposit payments?

+

Absolutely! Many payroll check printing software solutions offer direct deposit capabilities, allowing you to deposit funds directly into your employees’ bank accounts. This not only streamlines the payment process but also reduces the need for physical checks.

How can I ensure data security when using payroll check printing software?

+

To ensure data security, opt for software with robust security measures, including encryption, multi-factor authentication, and role-based access control. Regularly update your software to patch any security vulnerabilities and educate your employees about best practices for data protection.

What integration options should I look for in payroll check printing software?

+

Integration with existing HR, accounting, and time-tracking software is crucial. Look for payroll check printing software that seamlessly integrates with popular platforms like QuickBooks, ADP, or Zenefits. This integration ensures a smooth flow of data and simplifies your overall payroll process.