Mileage Reimbursement: The Ultimate Guide

In the business world, where professionals often need to travel for work, understanding and navigating the complex world of mileage reimbursement is crucial. Mileage reimbursement is a critical aspect of expense management, ensuring employees are fairly compensated for their business-related travel. This guide aims to provide an in-depth exploration of mileage reimbursement, offering practical insights, industry-specific strategies, and a comprehensive understanding of its importance.

Understanding Mileage Reimbursement

Mileage reimbursement is a business expense practice where employers compensate employees for the use of their personal vehicles for work-related purposes. This compensation is typically calculated based on the number of miles driven and a standard mileage rate set by governing bodies or organizations.

The purpose of mileage reimbursement is twofold: first, it ensures employees are not financially burdened by the costs of business travel, and second, it simplifies the expense reporting process for both employees and employers. By providing a standardized rate, employers can easily calculate and reimburse employees for their travel expenses, while employees can quickly and accurately report their mileage without the need for detailed expense tracking.

Standard Mileage Rates

Standard mileage rates are established by tax authorities and organizations like the Internal Revenue Service (IRS) to provide a fair and consistent benchmark for mileage reimbursement. These rates are updated annually to account for changes in fuel costs and other relevant factors. For instance, the IRS standard mileage rate for 2023 is 0.585 per mile for business travel, up from 0.56 per mile in 2022.

| Year | IRS Standard Mileage Rate (Business) |

|---|---|

| 2023 | $0.585 per mile |

| 2022 | $0.56 per mile |

| 2021 | $0.56 per mile |

It's important to note that while the IRS rate is a widely accepted standard, some businesses may choose to use their own rates, especially if they have specific industry considerations or unique travel requirements.

When is Mileage Reimbursement Applicable?

Mileage reimbursement is typically applicable for business travel that is not part of an employee’s regular commute. This includes travel to meet clients, attend conferences or training, visit job sites, or perform any other work-related tasks outside the employee’s primary workplace.

However, it's crucial to differentiate between personal and business travel. Personal travel, such as commuting to and from the office, is not eligible for mileage reimbursement. Similarly, if an employee chooses to take a scenic route or detours for personal reasons during a business trip, those additional miles are not reimbursable.

The Importance of Mileage Reimbursement

Mileage reimbursement is a critical component of employee expense management for several reasons:

- Employee Satisfaction and Morale: Fair and prompt mileage reimbursement can significantly impact employee satisfaction and overall morale. When employees feel their travel expenses are appropriately covered, they are more likely to be engaged and productive.

- Financial Transparency and Trust: A clear and consistent mileage reimbursement policy builds trust between employers and employees. It ensures employees are not financially burdened by work-related travel and fosters an environment of transparency and fairness.

- Cost Control and Planning: For businesses, a well-defined mileage reimbursement policy helps control travel-related costs. By setting a standard rate and clearly outlining reimbursable scenarios, businesses can budget effectively and plan for future travel expenses.

- Compliance with Tax Laws: Mileage reimbursement is subject to tax regulations. By adhering to standard rates and proper documentation, businesses can ensure compliance with tax laws and avoid potential legal issues.

The Impact of Mileage Reimbursement on Employee Productivity

When employees are reimbursed fairly and promptly for their travel expenses, it can have a positive impact on their overall productivity. They are more likely to be motivated and focused on their work, knowing that their financial interests are taken care of. Additionally, by removing the financial burden of business travel, employees can better concentrate on their tasks and deliver their best work.

Implementing an Effective Mileage Reimbursement Policy

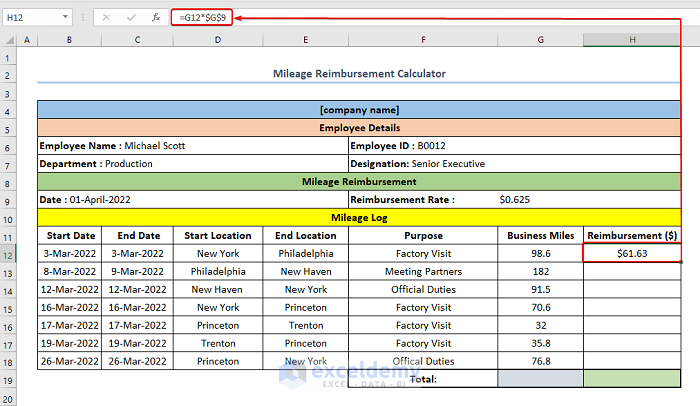

Developing and implementing an effective mileage reimbursement policy involves several key steps:

1. Research and Benchmarking

Before setting your mileage reimbursement rate, research the standard rates set by governing bodies and industry peers. Understanding the market rate will help you set a fair and competitive rate for your business.

For instance, if your industry has a high demand for travel, you might consider a slightly higher rate to incentivize employees and attract top talent. Conversely, if travel is less frequent, you might opt for a more conservative rate to control costs.

2. Define Reimbursable Scenarios

Clearly outline the scenarios where mileage reimbursement is applicable. This could include travel to client meetings, site visits, training sessions, and any other work-related trips. Define what constitutes a business trip and what is considered a personal trip.

For example, if an employee travels to a client meeting but decides to visit a personal contact nearby, the additional miles for the personal visit would not be reimbursable.

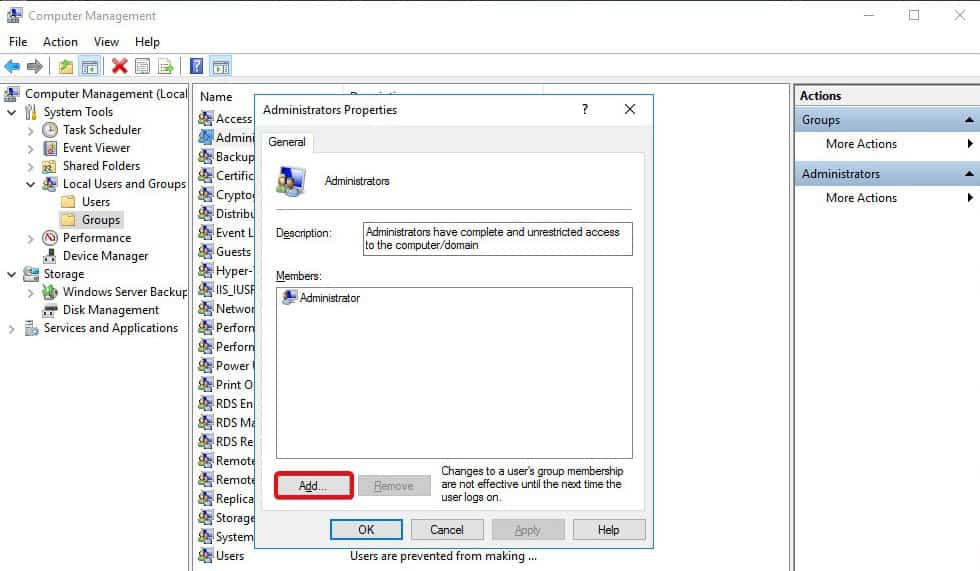

3. Choose a Tracking Method

Decide on a method for employees to track and report their mileage. This could be through a traditional paper logbook, a digital mileage tracking app, or an integrated GPS system in company vehicles. Ensure the chosen method is easy to use and provides accurate mileage data.

Some businesses opt for a more simplified approach by providing a daily or weekly mileage allowance, especially for employees with frequent local travel.

4. Establish a Reimbursement Process

Develop a clear and efficient reimbursement process. This should include instructions for employees on how to submit their mileage reports, the required documentation, and the turnaround time for reimbursement.

Consider using digital tools or expense management software to streamline the process and reduce administrative burden. These tools can automate calculations, track submissions, and ensure compliance with your reimbursement policy.

Common Challenges and Solutions in Mileage Reimbursement

Implementing a mileage reimbursement policy can come with its own set of challenges. Here are some common issues and practical solutions:

1. Inaccurate Mileage Tracking

Challenge: Inaccurate mileage tracking can lead to over or under-reimbursement, impacting both employees and the business’s finances.

Solution: Implement a robust mileage tracking system. Encourage employees to use digital tracking apps that integrate with GPS for real-time, accurate data. Regularly review mileage reports to identify any discrepancies and provide feedback to employees.

2. Delayed Reimbursements

Challenge: Delayed reimbursements can cause financial strain for employees and lead to dissatisfaction.

Solution: Establish a streamlined reimbursement process with clear timelines. Use digital payment methods to expedite reimbursements. Communicate these timelines to employees and provide regular updates if there are any delays.

3. Tax Compliance

Challenge: Mileage reimbursement is subject to tax regulations, and non-compliance can lead to legal issues.

Solution: Stay updated with tax laws and regulations. Work with your accounting team or tax advisors to ensure your reimbursement policy and practices are compliant. Educate employees on their tax responsibilities regarding mileage reimbursement.

4. Fraud and Misuse

Challenge: There is a risk of fraud or misuse of the mileage reimbursement system, where employees might inflate mileage or submit false reports.

Solution: Implement a robust verification process. Cross-reference mileage reports with travel itineraries or GPS data. Regularly audit a sample of mileage reports to ensure accuracy. Establish a clear policy on consequences for fraud or misuse.

Mileage Reimbursement: A Strategic Advantage

When implemented effectively, mileage reimbursement can be a strategic advantage for businesses. It not only ensures compliance with tax laws and fair compensation for employees but also enhances employee satisfaction and productivity.

By developing a well-defined policy and using technology to streamline the process, businesses can turn mileage reimbursement into a tool for cost control, financial planning, and talent retention. It's an essential aspect of modern expense management, reflecting a business's commitment to its employees and their financial well-being.

Conclusion

Mileage reimbursement is a critical aspect of business travel management, impacting both employees and employers. By understanding the importance, challenges, and strategies associated with mileage reimbursement, businesses can develop effective policies that promote financial fairness, transparency, and employee satisfaction.

With the right approach, mileage reimbursement can be a strategic tool for businesses, helping them navigate the complexities of employee expense management and foster a culture of trust and productivity.

FAQ

How often should employees submit mileage reports for reimbursement?

+

Employees should submit mileage reports on a regular basis, typically monthly or quarterly. This ensures timely reimbursement and accurate record-keeping. However, for frequent travelers, more frequent submissions might be necessary to avoid administrative backlog.

Can businesses offer a mileage allowance instead of reimbursement based on actual miles driven?

+

Yes, some businesses opt for a mileage allowance, especially for employees with frequent local travel. This simplifies the reimbursement process and can be a cost-effective strategy for businesses. However, it’s important to ensure the allowance is fair and covers the average travel needs of employees.

What are the tax implications for mileage reimbursement?

+

Mileage reimbursement is subject to tax regulations. Employees must include the reimbursed amount in their taxable income. Businesses should consult with tax advisors to ensure compliance with tax laws and provide employees with guidance on their tax responsibilities.

Are there any alternatives to mileage reimbursement for businesses with low travel needs?

+

For businesses with low travel needs, alternatives like a travel budget or per diem allowance might be more suitable. A travel budget can cover all travel expenses, including mileage, while a per diem allowance provides a daily rate for meals and incidental expenses.

How can businesses ensure the accuracy of mileage reports?

+

Businesses can ensure accuracy by implementing a robust mileage tracking system. This could include GPS-integrated apps or devices that automatically record mileage. Regular audits and cross-referencing with other travel records can also help identify discrepancies.