Debt Financing: The Basics Unveiled

In the world of business and finance, understanding the fundamentals of debt financing is crucial for entrepreneurs, investors, and financial analysts alike. This comprehensive guide aims to unravel the complexities surrounding debt financing, providing an in-depth exploration of its principles, advantages, challenges, and practical applications.

Understanding Debt Financing

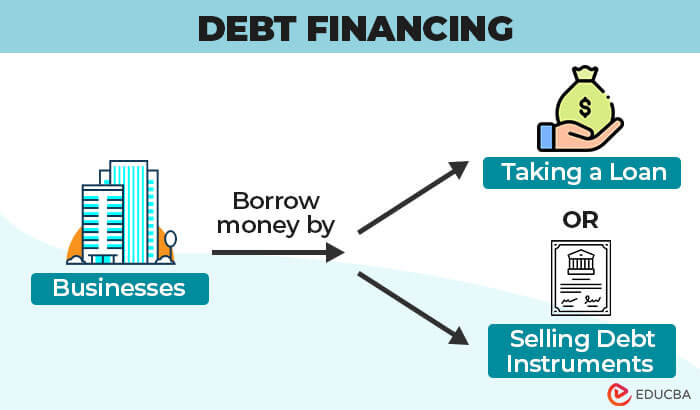

Debt financing, a cornerstone of modern financial management, involves securing funds for business operations or investments through borrowing. Unlike equity financing, which involves selling ownership stakes, debt financing entails obtaining capital as loans that must be repaid, typically with interest, over a specified period.

This form of financing is a cornerstone of economic growth, enabling businesses to expand, innovate, and navigate financial hurdles. From start-ups seeking capital for growth to established enterprises requiring funds for expansion, debt financing offers a flexible and accessible avenue for funding.

Key Principles of Debt Financing

- Borrowing and Repayment: At its core, debt financing revolves around borrowing funds and repaying them over time. This process involves careful planning, considering factors like interest rates, repayment schedules, and the overall financial health of the borrower.

- Interest and Fees: Borrowers incur interest and fees as costs associated with debt financing. Interest rates can vary based on factors such as creditworthiness, the purpose of the loan, and market conditions. Understanding these costs is essential for effective financial planning.

- Collateral and Security: Many debt financing options require borrowers to provide collateral, such as assets or property, as security for the loan. This ensures that lenders have a form of protection in case the borrower defaults on the loan.

Advantages of Debt Financing

Debt financing offers a range of benefits that make it an attractive option for businesses and investors.

Enhanced Financial Flexibility

One of the primary advantages of debt financing is the enhanced financial flexibility it provides. Businesses can access funds quickly and utilize them for various purposes, from covering operational expenses to investing in new projects. This flexibility allows companies to seize opportunities and adapt to changing market dynamics.

| Flexibility Highlights | Real-World Example |

|---|---|

| Quick Access to Funds | A start-up technology company can secure a loan to develop its innovative product, bringing it to market faster. |

| Diverse Funding Uses | An established retailer might use debt financing to renovate its stores, improve customer experience, and boost sales. |

Preserving Ownership and Control

Unlike equity financing, debt financing does not involve diluting ownership or ceding control. Borrowers retain full ownership and decision-making power over their business. This aspect is particularly appealing to entrepreneurs who wish to maintain autonomy and avoid external influence.

Tax Benefits

Interest payments on debt financing are often tax-deductible, providing a significant advantage. Businesses can reduce their taxable income, resulting in potential tax savings. This benefit makes debt financing an attractive option for financially savvy entrepreneurs.

Challenges and Considerations

While debt financing offers numerous advantages, it also presents challenges and considerations that borrowers must navigate.

Interest and Repayment Management

Managing interest payments and repayment schedules is crucial for the long-term financial health of a business. Borrowers must carefully assess their ability to meet these obligations without straining their cash flow. Mismanagement can lead to financial distress and, in extreme cases, bankruptcy.

Creditworthiness and Lender Relations

Borrowers’ creditworthiness plays a pivotal role in accessing debt financing. Lenders assess factors such as credit history, financial stability, and collateral to determine the borrower’s eligibility and terms. Maintaining positive relationships with lenders is essential for future financing opportunities.

Risk of Default

Defaulting on debt obligations is a significant risk. It can damage a borrower’s creditworthiness, lead to legal consequences, and hinder future access to financing. Effective financial planning and risk management are crucial to mitigate this risk.

Practical Applications of Debt Financing

Debt financing finds application in various scenarios, each presenting unique opportunities and considerations.

Start-up Funding

For start-ups, debt financing can provide the initial capital needed to launch and grow a business. It allows entrepreneurs to avoid diluting their ownership and maintain control over their venture.

Business Expansion and Growth

Established businesses often turn to debt financing to fuel expansion, acquire new assets, or enter new markets. This form of financing can be particularly advantageous for companies with a proven track record and stable cash flow.

Equipment and Asset Acquisition

Businesses may utilize debt financing to acquire specific assets, such as equipment or vehicles, necessary for their operations. This strategy allows them to preserve cash and leverage the acquired assets as collateral.

Working Capital Management

Debt financing can also be employed to manage working capital, providing a short-term infusion of funds to cover operational expenses during periods of high demand or cash flow fluctuations.

Future Implications and Trends

The landscape of debt financing is dynamic, influenced by economic trends, technological advancements, and regulatory changes. Here are some key future implications and trends to consider.

Technological Innovations

The rise of fintech (financial technology) has revolutionized debt financing. Online lending platforms and digital financial services offer streamlined processes, improved accessibility, and innovative lending models, transforming the borrowing experience.

Sustainable and Impact Investing

There is a growing trend towards sustainable and impact investing, where investors seek not only financial returns but also positive social and environmental impact. This trend is influencing debt financing, with lenders and borrowers increasingly focusing on sustainable practices and responsible lending.

Regulation and Compliance

Regulatory changes and compliance requirements continue to shape the debt financing landscape. Borrowers and lenders must stay updated on these changes to ensure legal and ethical practices.

Alternative Lending Sources

The rise of alternative lending sources, such as peer-to-peer lending and crowdfunding, provides borrowers with diverse financing options. These platforms offer flexibility and accessibility, especially for smaller businesses and start-ups.

Conclusion

Debt financing is a fundamental pillar of financial management, offering businesses and investors a powerful tool for growth and expansion. By understanding its principles, advantages, and challenges, individuals can make informed decisions and navigate the complex world of borrowing with confidence.

Frequently Asked Questions

What is the primary difference between debt financing and equity financing?

+

Debt financing involves borrowing funds with the obligation to repay them, often with interest. Equity financing, on the other hand, involves selling ownership stakes in a business, giving up a portion of control and ownership. Debt financing preserves ownership, while equity financing dilutes it.

How do interest rates impact debt financing decisions?

+

Interest rates play a crucial role in debt financing. Lower interest rates make borrowing more attractive, as they reduce the cost of financing. Borrowers must consider interest rates when evaluating the affordability and long-term impact of debt on their finances.

What are some common sources of debt financing for businesses?

+

Businesses have various options for debt financing, including traditional lenders like banks, credit unions, and online lenders. Additionally, businesses can explore alternative financing sources such as peer-to-peer lending, invoice financing, and asset-based lending.