Cumulative Data Visualized: MT5 Bar Charts

In the realm of data visualization, the choice of chart type is pivotal for effective communication. One powerful tool in the arsenal of data analysts and traders is the bar chart, and when it comes to MetaTrader 5 (MT5), this chart type takes on a whole new dimension.

MT5, a popular trading platform, offers an array of visualization tools to help traders interpret market data. Among these, the bar chart stands out as a versatile and informative graphical representation. In this article, we delve into the world of MT5 bar charts, exploring their significance, functionality, and the insights they provide to traders and analysts.

The Significance of MT5 Bar Charts

Bar charts are a fundamental tool in the data visualization toolkit, offering a clear and concise representation of data. In the context of MT5, these charts play a crucial role in price movement analysis, trend identification, and overall market understanding.

Traders and analysts utilize bar charts to visualize historical price data, which includes open, high, low, and close prices for a given period. This visual representation allows for a rapid assessment of market trends, price volatility, and potential trading opportunities. The simplicity and effectiveness of bar charts make them a go-to choice for many traders, especially when combined with the advanced features of MT5.

Understanding MT5 Bar Chart Features

MT5 bar charts offer a wealth of features that enhance their utility for traders. Let’s explore some key aspects:

Open, High, Low, and Close Prices

Each bar on an MT5 chart represents a specific time frame and displays four critical price points: open, high, low, and close. The open price is represented by a small horizontal line on the left side of the bar, while the close price is on the right. The high and low prices are indicated by the top and bottom of the vertical bar, respectively. This visual representation provides a quick glimpse into the price action during the selected time frame.

| Time Frame | Open Price | High Price | Low Price | Close Price |

|---|---|---|---|---|

| 15-minute bar | $245.30 | $247.50 | $244.80 | $246.20 |

| 1-hour bar | $246.20 | $248.10 | $245.10 | $247.80 |

The above table showcases an example of price data for two different time frames. The visual representation of these data points on an MT5 bar chart provides traders with a clear understanding of the price action during those periods.

Time Frames and Periods

MT5 bar charts offer flexibility in time frames, allowing traders to analyze data at different intervals. Whether it’s a 5-minute, 1-hour, daily, or weekly bar chart, traders can choose the time frame that aligns with their trading strategy and market analysis needs. This adaptability is crucial for traders who may focus on short-term intraday movements or long-term trends.

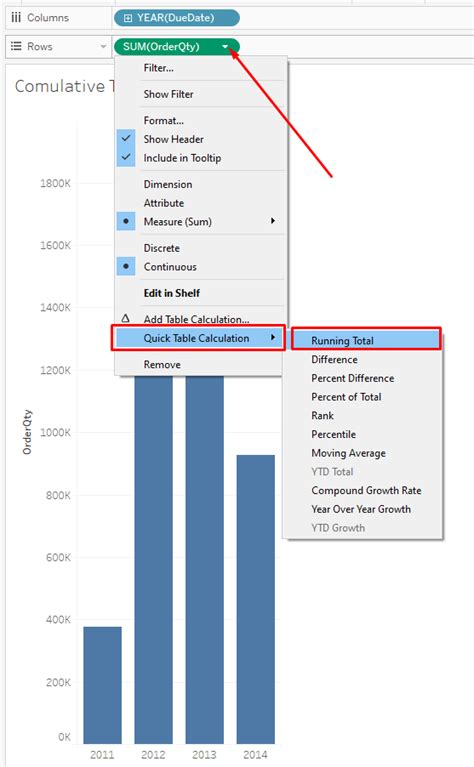

Customizable Visual Settings

MT5 charts are highly customizable, enabling traders to personalize their visual experience. Traders can adjust the color of bars, grid lines, and chart backgrounds to enhance readability and match their preferences. Additionally, MT5 offers various chart styles, such as line charts, candlestick charts, and, of course, bar charts, giving traders the flexibility to choose the visual representation that suits their analysis style.

Technical Analysis Indicators

One of the standout features of MT5 bar charts is their ability to integrate technical analysis indicators seamlessly. Traders can overlay various indicators, such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, directly onto the chart. This integration provides a holistic view of the market, allowing traders to identify potential trading signals and make informed decisions.

Analyzing Price Movement with MT5 Bar Charts

MT5 bar charts provide a visual narrative of price movement, offering insights into market trends and potential trading opportunities. Let’s explore some key aspects of price analysis using these charts:

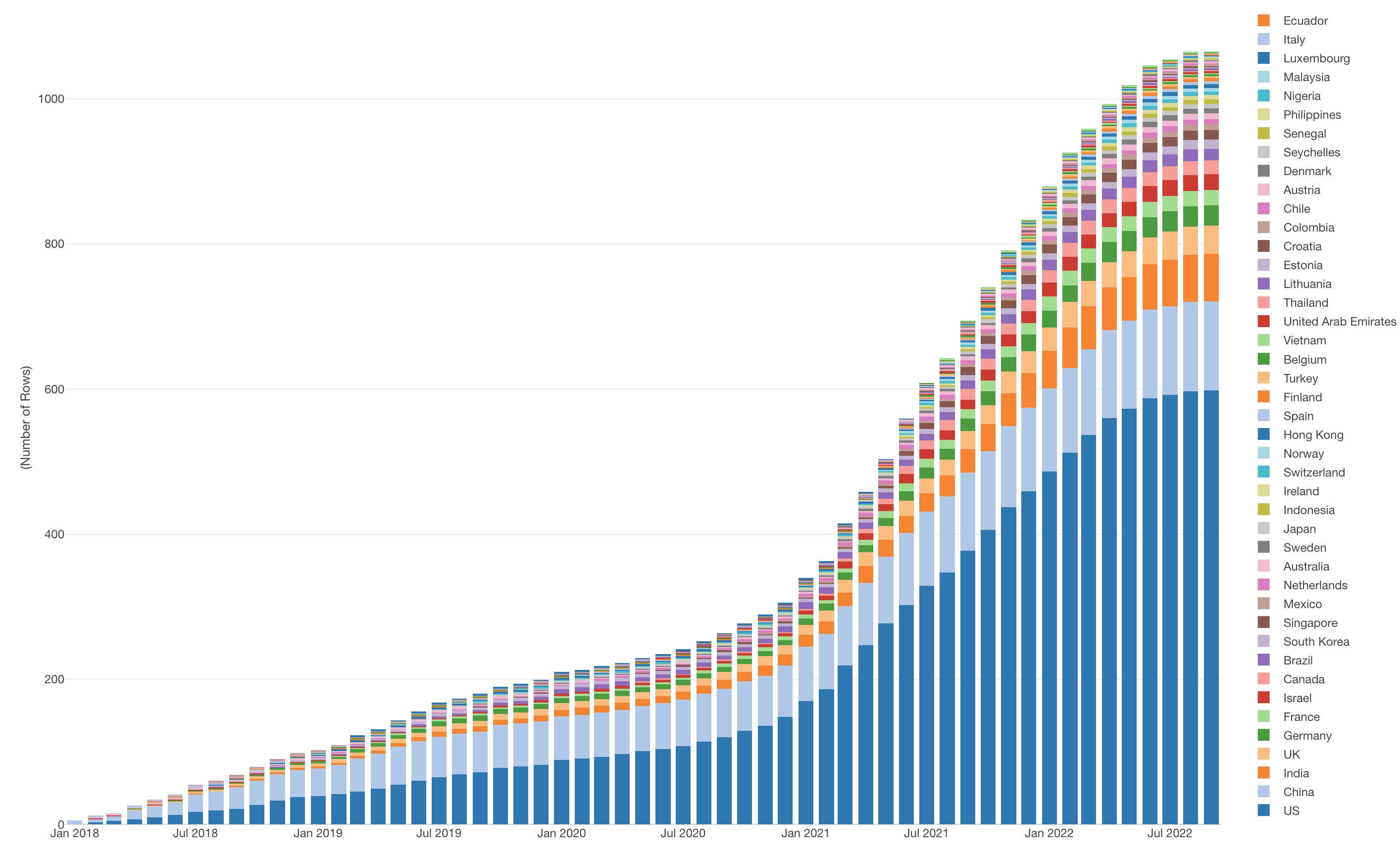

Trending Markets

In a trending market, MT5 bar charts become powerful tools for identifying and confirming trends. Traders can observe the consistent direction of bar closings, indicating an upward or downward trend. Additionally, the length and slope of the bars provide insights into the strength and momentum of the trend. For instance, long bars with steep slopes suggest a strong trend, while shorter bars with less slope indicate a weaker trend.

Range-Bound Markets

Range-bound markets, characterized by price fluctuations within a defined range, can also be analyzed effectively using MT5 bar charts. Traders look for patterns such as repeated high and low points, which indicate potential support and resistance levels. The length and consistency of bars within the range can help traders identify potential breakouts or reversals.

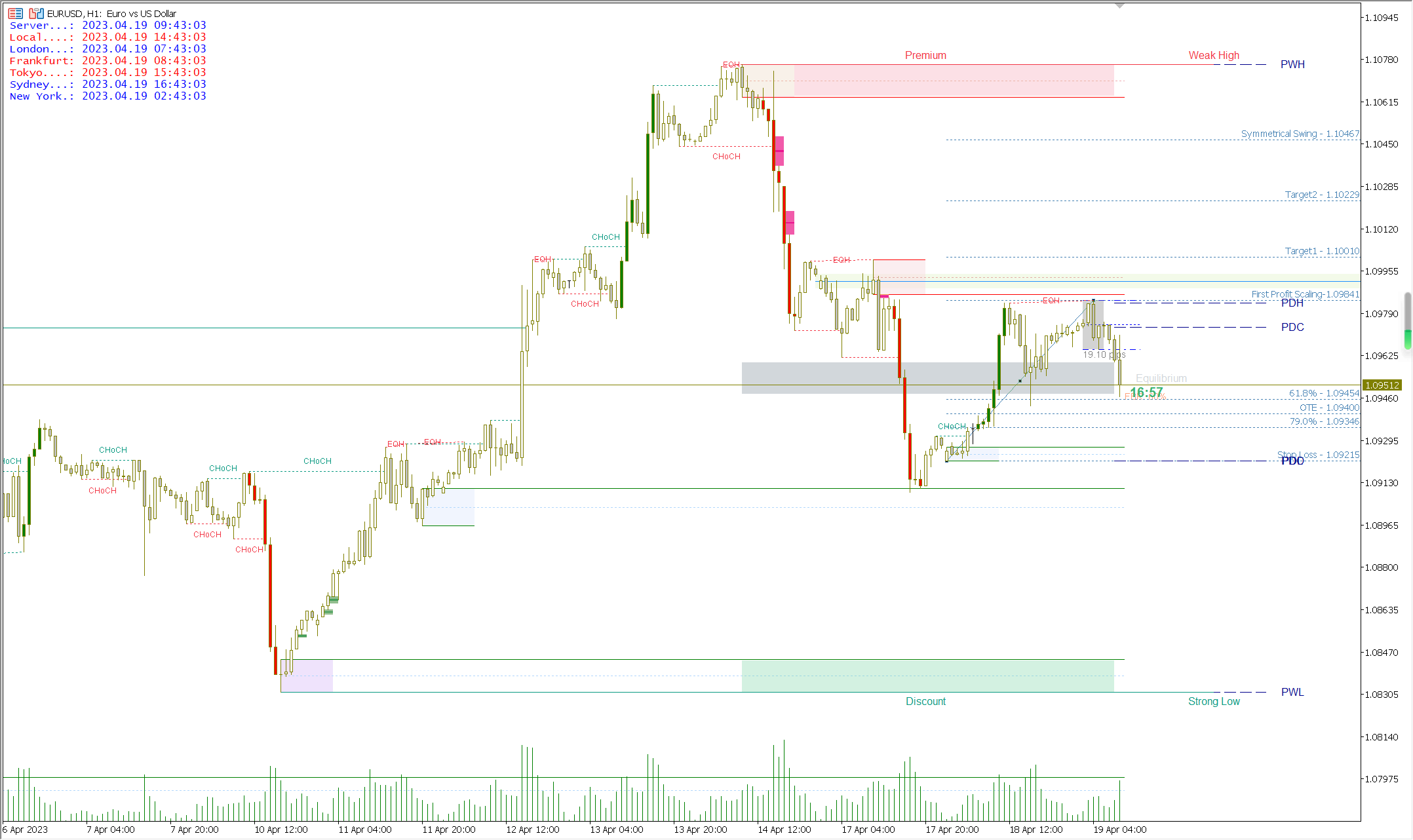

Price Patterns and Chart Patterns

MT5 bar charts excel at highlighting price patterns and chart patterns, which are crucial for technical analysis. Traders can identify common patterns such as triangles, head and shoulders, or double tops and bottoms. These patterns often indicate potential reversals or continuations of trends, providing traders with valuable insights for their trading strategies.

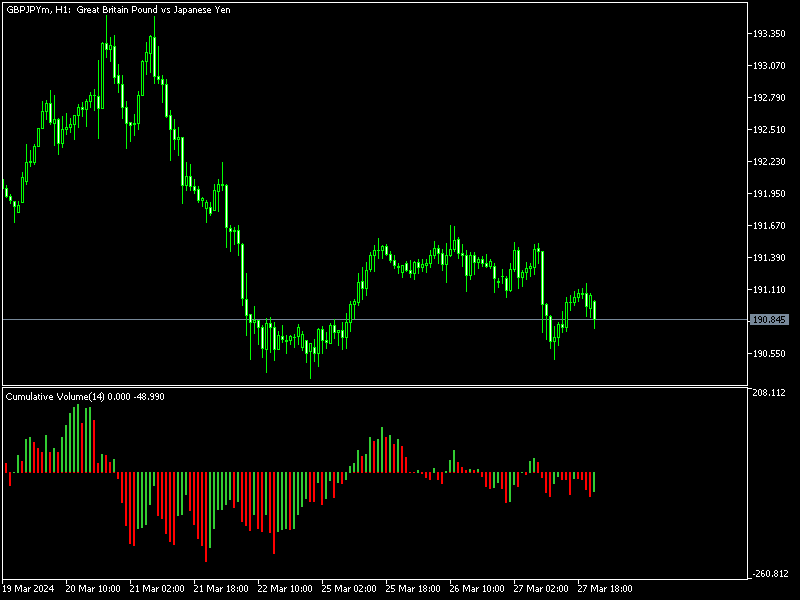

Volume Analysis

MT5 bar charts can be coupled with volume indicators to provide a more comprehensive view of market activity. Traders can analyze the relationship between price movements and volume to identify potential market sentiment shifts. For instance, an increase in volume during a price breakout may suggest a strong market movement, while a lack of volume could indicate a potential reversal.

Advanced Trading Strategies with MT5 Bar Charts

MT5 bar charts serve as a foundation for various trading strategies, offering traders the flexibility to adapt and refine their approaches. Here are a few advanced strategies that leverage the power of MT5 bar charts:

Breakout Trading

Breakout trading involves identifying and trading price movements that break through defined support or resistance levels. MT5 bar charts are ideal for visualizing these levels and potential breakout points. Traders can set alerts or place orders based on the chart’s visual indications, allowing them to capitalize on significant market movements.

Trend Following

Traders who follow trends can utilize MT5 bar charts to identify and ride market trends. By analyzing the direction and strength of bar closings, traders can enter positions in the direction of the trend and manage risk accordingly. MT5’s advanced chart tools and indicators further enhance trend-following strategies, providing traders with a competitive edge.

Range Trading

In range-bound markets, MT5 bar charts help traders identify the upper and lower boundaries of the range. Traders can then employ strategies such as buying near support levels and selling near resistance levels, aiming to profit from the price fluctuations within the range. The visual representation of the range on the chart provides a clear reference point for traders.

Scalping and Intraday Trading

For scalpers and intraday traders, MT5 bar charts offer a detailed view of short-term price movements. By analyzing the bars on smaller time frames, traders can identify quick price fluctuations and potential entry and exit points. The ability to customize time frames and overlay indicators on MT5 charts makes it an ideal platform for intraday trading strategies.

Conclusion: The Power of MT5 Bar Charts

MT5 bar charts are a versatile and powerful tool for traders and analysts, offering a clear and concise representation of market data. From identifying trends and patterns to facilitating advanced trading strategies, these charts are integral to the trading process. The ability to customize, analyze, and integrate technical indicators makes MT5 bar charts a go-to choice for traders seeking a comprehensive understanding of market dynamics.

As we've explored, MT5 bar charts provide a visual narrative that enhances traders' decision-making abilities. By combining the platform's advanced features with a solid understanding of market analysis, traders can unlock the full potential of MT5 bar charts and take their trading to new heights.

Frequently Asked Questions

How do I customize the visual settings of an MT5 bar chart?

+To customize the visual settings, right-click on the chart and select “Properties” or use the keyboard shortcut “Ctrl + L.” This will open the Chart Properties window, where you can adjust color schemes, grid styles, and other visual preferences.

Can I use multiple time frames simultaneously on an MT5 bar chart?

+Yes, MT5 allows you to display multiple time frames on the same chart. Simply select the “Timeframes” tab in the Chart Properties window and choose the additional time frames you wish to overlay. This feature provides a comprehensive view of market dynamics across different time horizons.

How do I add technical indicators to my MT5 bar chart?

+To add technical indicators, right-click on the chart and select “Indicators List.” Alternatively, use the “Ctrl + I” shortcut. This will open the Indicator List window, where you can browse and select the indicators you wish to add. You can then customize their settings and position them on the chart as needed.

What is the significance of volume analysis in conjunction with MT5 bar charts?

+Volume analysis provides context to price movements by indicating market participation and sentiment. When combined with MT5 bar charts, volume analysis helps traders identify potential trend reversals, breakouts, or continuations. High volume during significant price movements suggests a stronger market shift, while low volume may indicate a potential reversal or consolidation.