4 Steps to Form a Corporation

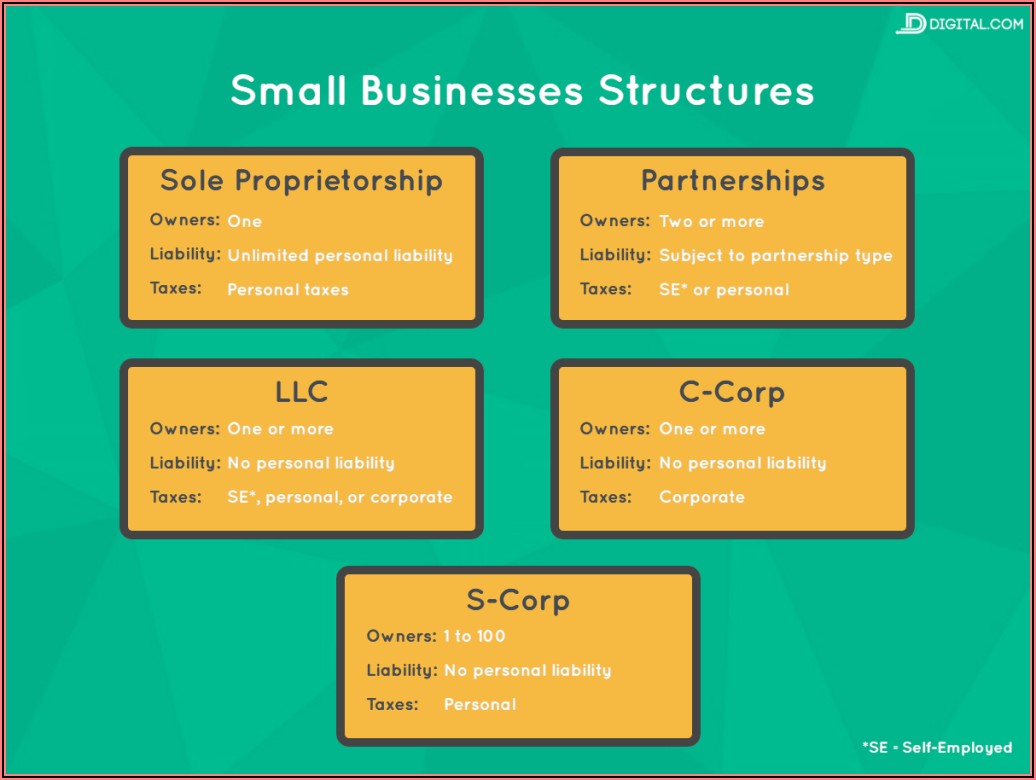

In the world of business, choosing the right legal structure is crucial for the success and growth of your venture. Forming a corporation offers numerous advantages, providing a solid foundation for your enterprise. This article will guide you through the essential steps to establish a corporation, shedding light on the process and its benefits.

Understanding the Corporation Structure

A corporation is a distinct legal entity, separate from its owners and shareholders. This structure offers limited liability protection, meaning that the personal assets of owners are generally safe from business debts and liabilities. Additionally, corporations have a perpetual existence, ensuring continuity even if owners change.

One of the key advantages of a corporation is its ability to attract investors. By issuing shares, corporations can easily raise capital, making it an attractive option for businesses seeking expansion. Furthermore, corporations enjoy tax benefits, as they can deduct business expenses and take advantage of tax credits. This structure also allows for a more structured management system, with clear roles and responsibilities defined for directors and officers.

Step 1: Choose a Name and Determine Your Business Activity

The first step in forming a corporation is selecting a unique and distinctive name. This name should reflect your business’s nature and purpose. It’s essential to check if the chosen name is available and not already registered by another entity. You can typically perform this search through your state’s business registration office or online business entity databases.

Along with choosing a name, you must define your business activity. This involves determining the primary products or services your corporation will offer. Clearly defining your business activity is crucial for legal and tax purposes, as it will impact the permits, licenses, and regulations your corporation must comply with.

Key Considerations for Naming Your Corporation

- Avoid using restricted words like “Bank” or “University” unless you have the necessary authorization.

- Consider including words that describe your business or its unique selling point.

- Ensure the name is easy to remember and spells correctly.

- Check if the domain name for your chosen business name is available for a professional online presence.

| Business Activity | Description |

|---|---|

| Retail Sales | Selling goods directly to consumers through physical stores or online platforms. |

| Manufacturing | Producing goods or products through various manufacturing processes. |

| Consulting Services | Providing professional advice and expertise in specific fields. |

| Healthcare | Offering medical services, treatments, or healthcare-related products. |

Step 2: Choose a State for Incorporation and Appoint Registered Agents

The next step is deciding where to incorporate your business. While you can choose any state, it’s essential to consider factors like tax laws, business regulations, and the state’s overall business-friendly environment. Some states, like Delaware and Nevada, are known for their business-friendly regulations and flexible corporate laws.

Once you've chosen a state, you must appoint a registered agent. A registered agent is an individual or business entity responsible for receiving legal documents, tax notices, and other official correspondence on behalf of your corporation. This agent must have a physical address in the state where your corporation is registered. You can choose to be your own registered agent or appoint a professional service provider.

Factors to Consider When Choosing a State for Incorporation

- Tax rates and business tax incentives offered by the state.

- Business regulations and compliance requirements.

- Ease of doing business and the state’s reputation for supporting entrepreneurship.

- Availability of resources and support for your specific industry.

| State | Advantages |

|---|---|

| Delaware | Flexible corporate laws, experienced courts, and efficient business services. |

| Nevada | Strong privacy protections, no state corporate income tax, and a business-friendly environment. |

| Wyoming | Low fees, strong asset protection, and no state corporate income tax. |

| Florida | No state income tax on corporations, pro-business regulations, and a large consumer market. |

Step 3: File Articles of Incorporation and Complete Necessary Paperwork

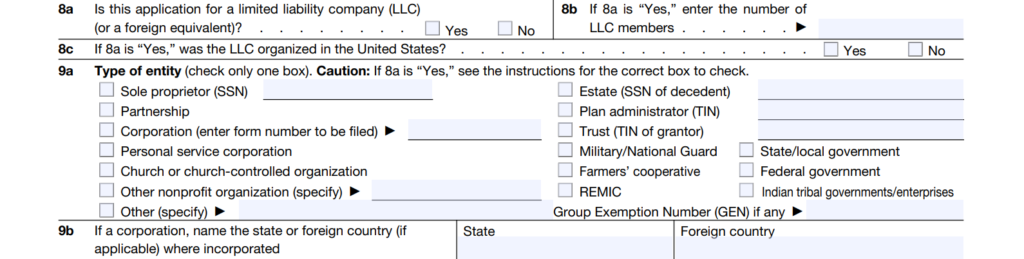

The third step is filing the articles of incorporation with the state’s business registration office. This document outlines the basic information about your corporation, including its name, purpose, registered agent, and initial directors.

Along with the articles of incorporation, you'll need to complete other paperwork, such as corporate bylaws, which establish the rules and procedures for your corporation's internal operations. These bylaws cover topics like shareholder meetings, voting rights, and the responsibilities of directors and officers.

Key Information to Include in Your Articles of Incorporation

- Corporation name and its registered address.

- Nature of the business and its primary activities.

- Number and value of authorized shares.

- Names and addresses of initial directors and officers.

- Duration of the corporation (usually perpetual unless specified otherwise)

| Corporate Bylaws | Key Components |

|---|---|

| Shareholder Meetings | Frequency, notice requirements, and voting procedures for shareholder meetings. |

| Board of Directors | Qualifications, duties, and powers of directors. |

| Officers | Roles and responsibilities of corporate officers (e.g., CEO, CFO, etc.) |

| Stock Transfer | Procedures for transferring shares and maintaining stock records. |

Step 4: Obtain Necessary Licenses and Permits

Once your corporation is legally established, you must obtain the necessary licenses and permits to operate your business. The specific requirements vary depending on your business activity, industry, and location. Some common licenses and permits include:

- Business licenses: General permits required to operate a business in a specific location.

- Industry-specific licenses: Permits required for certain industries, such as healthcare or construction.

- Tax registrations: Registrations needed to collect and remit taxes, including sales tax and payroll tax.

- Environmental permits: Permits related to environmental regulations and waste management.

Resources for Obtaining Licenses and Permits

- Check with your state’s business licensing office or department of commerce for general business license requirements.

- Research industry-specific licensing boards or regulatory agencies for your particular business activity.

- Utilize online resources like the Small Business Administration (SBA) or your state’s business support websites for guidance.

| License/Permit | Description |

|---|---|

| Sales Tax Permit | Required for businesses selling goods or services, allowing them to collect and remit sales tax. |

| Health Permit | Necessary for businesses in the food and beverage industry, ensuring compliance with health and safety regulations. |

| Building Permit | Required for construction or renovation projects, ensuring compliance with building codes and regulations. |

| Professional License | Specific to certain professions like law, medicine, or accounting, ensuring practitioners meet required standards. |

Conclusion: Embracing the Benefits of a Corporation

Forming a corporation is a significant step for any business, offering numerous advantages in terms of liability protection, capital access, and tax benefits. By following these four steps—choosing a name and business activity, selecting a state for incorporation, filing the necessary paperwork, and obtaining licenses and permits—you can establish a solid foundation for your corporation’s success.

Remember, the process of forming a corporation may vary slightly depending on your state's regulations and your business's unique needs. It's always beneficial to seek professional advice and utilize reputable online resources to ensure a smooth and compliant incorporation process.

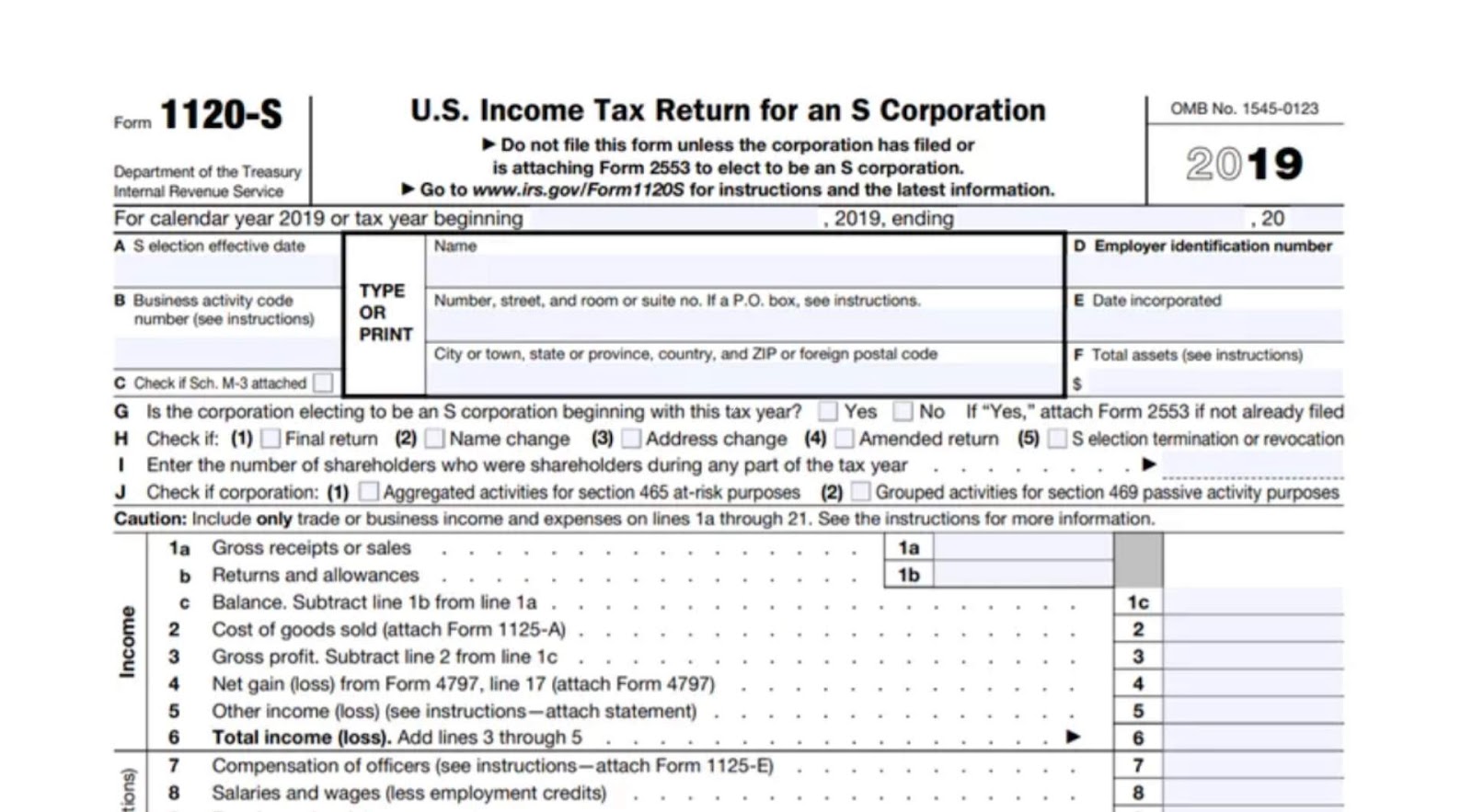

What are the tax benefits of forming a corporation?

+Corporations enjoy several tax advantages. They can deduct business expenses, take advantage of tax credits, and may benefit from lower tax rates compared to other business structures. Additionally, corporations can choose to be taxed as an S corporation, further reducing tax liabilities.

Can I form a corporation in multiple states?

+Yes, you can form a corporation in multiple states. This is known as foreign qualification. It allows your corporation to conduct business in different states while maintaining the benefits of your initial state of incorporation. However, there may be additional filing requirements and fees.

What are the ongoing compliance requirements for a corporation?

+Corporations have ongoing compliance requirements, including annual report filings, franchise tax payments, and maintaining corporate records. Additionally, corporations must hold annual shareholder and board meetings and keep accurate minutes of these meetings.