Calculate Your Earnings: 22 Dollars an Hour

When it comes to understanding your earnings and how they stack up, it's essential to delve into the specifics. In this article, we will explore the intricacies of earning $22 per hour and what it means for your financial journey. Whether you're a seasoned professional or just starting out, this breakdown will provide valuable insights into the potential of your hourly wage.

Unraveling the Hourly Earnings: A Comprehensive Analysis

Earning $22 per hour is a significant milestone for many individuals, offering a glimpse into the possibilities of financial stability and growth. Let’s break down the numbers and explore the implications of this hourly rate.

The Math Behind the Hourly Wage

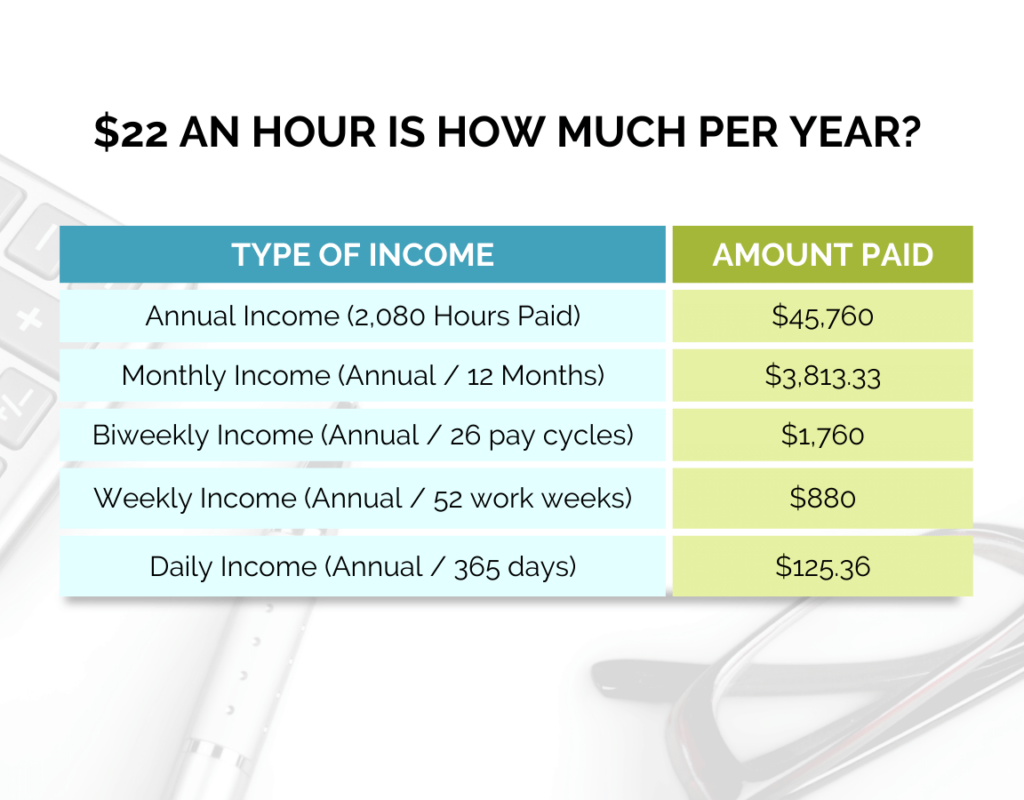

To fully grasp the impact of $22 per hour, we need to consider the various factors that contribute to your overall earnings. Here’s a step-by-step breakdown:

- Hourly Rate: Your starting point is the $22 per hour wage, which serves as the foundation for your financial calculations.

- Hours Worked: The number of hours you dedicate to your job directly influences your earnings. On average, a full-time job entails approximately 40 hours of work per week.

- Weekly Earnings: By multiplying your hourly rate by the number of hours worked, you can estimate your weekly earnings. In this case, $22 per hour multiplied by 40 hours equals $880 per week.

- Bi-Weekly Pay: Many employers pay their employees every two weeks. To calculate your bi-weekly earnings, you simply multiply your weekly earnings by 2, resulting in $1,760 for a typical bi-weekly pay period.

- Monthly Earnings: To estimate your monthly income, you can divide your bi-weekly earnings by 2 or multiply your weekly earnings by 4.3 (assuming a 52-week year with 2 weeks of paid vacation). This calculation yields an approximate monthly income of $3,776.

- Annual Earnings: For a more comprehensive view, let's calculate your annual earnings. By multiplying your weekly earnings by 52 (the number of weeks in a year), you arrive at an annual income of $45,760.

| Earnings Metric | Estimated Value |

|---|---|

| Hourly Rate | $22 |

| Weekly Earnings | $880 |

| Bi-Weekly Pay | $1,760 |

| Monthly Income | $3,776 |

| Annual Earnings | $45,760 |

These calculations provide a clear picture of the potential earnings associated with a $22 per hour wage. However, it's important to note that actual earnings may vary based on factors such as overtime, bonuses, and tax deductions.

Comparative Analysis: Where Does $22 per Hour Stand?

To understand the significance of your earnings, it’s beneficial to compare them to industry averages and other income levels. Here’s a comparative analysis:

- Minimum Wage: In many regions, the minimum wage serves as a benchmark for entry-level positions. For instance, the federal minimum wage in the United States is $7.25 per hour. When compared to this, your $22 per hour wage is nearly 3 times higher, indicating a substantial earning potential.

- Median Wage: The median wage represents the middle point in a range of earnings. According to recent data, the median wage in the United States is approximately $19 per hour. Your $22 per hour wage surpasses this median, placing you in a higher earning bracket.

- Professional Salaries: Depending on your industry and profession, salaries can vary significantly. For instance, a Software Engineer with a median salary of $100,000 per year equates to roughly $48 per hour on average. While your $22 per hour wage may not match this level, it serves as a solid foundation for further growth and advancement.

Maximizing Your Earnings Potential

While $22 per hour offers a solid starting point, there are strategies you can employ to maximize your earnings potential and achieve financial goals:

- Skill Development: Investing in your skills and education can lead to higher-paying opportunities. Whether it's pursuing certifications, attending workshops, or acquiring new qualifications, continuous learning can enhance your marketability and earning power.

- Negotiation: When negotiating salaries or discussing hourly rates, it's crucial to demonstrate your value and highlight your unique skills and contributions. Effective negotiation can result in higher earnings and improved job prospects.

- Exploring Side Gigs: Diversifying your income streams through side hustles or freelance work can boost your overall earnings. With platforms like Fiverr, Upwork, or local freelance marketplaces, you can leverage your skills to earn additional income.

- Savings and Investments: Managing your finances wisely is essential for long-term financial success. Consider setting aside a portion of your earnings for savings and investments, allowing your money to grow and providing financial security for the future.

The Impact of Taxes and Deductions

When calculating your take-home pay, it’s important to consider the impact of taxes and deductions. Here’s a simplified breakdown:

- Federal Income Tax: The amount of federal income tax you pay depends on your taxable income and filing status. For a single filer earning $45,760 annually, the federal income tax liability could range from $3,000 to $7,000, depending on various factors.

- State Income Tax: State income tax rates vary significantly across different states. Some states, like Texas and Florida, have no state income tax, while others, like California and New York, have progressive tax structures with higher rates for higher incomes.

- Social Security and Medicare Taxes: These taxes are typically deducted from your paycheck, contributing to social programs and healthcare coverage. The combined rate for these taxes is 7.65%, which means approximately $3,495 would be deducted from your annual earnings for these purposes.

- Other Deductions: Depending on your employment benefits and contributions, you may have additional deductions for health insurance, retirement plans, or other employee benefits. These deductions can further impact your take-home pay.

By understanding the impact of taxes and deductions, you can gain a clearer picture of your actual earnings and make informed financial decisions.

The Future of Earnings: Opportunities and Growth

As you continue your financial journey, it’s essential to stay informed about the evolving landscape of earnings and employment. Here are some key considerations for the future:

- Employment Trends: Keep an eye on industry trends and emerging job markets. Identifying in-demand skills and sectors can open up new opportunities for higher earnings and career growth.

- Remote Work and Freelancing: The rise of remote work and the gig economy has created new avenues for income generation. Exploring freelance opportunities or working remotely can offer flexibility and the potential for higher earnings.

- Entrepreneurship: For those with an entrepreneurial spirit, starting a business can be a rewarding path to financial independence. From consulting to e-commerce, there are numerous avenues to explore and build a successful venture.

- Financial Planning: Developing a comprehensive financial plan is crucial for long-term success. This includes setting clear financial goals, creating a budget, and exploring investment opportunities to grow your wealth over time.

Conclusion: Empowering Your Financial Journey

Understanding your earnings and the potential they hold is a powerful step towards financial empowerment. By analyzing your hourly rate, comparing it to industry averages, and exploring strategies to maximize your income, you can take control of your financial future. Remember, every journey begins with a single step, and $22 per hour is a solid foundation for building a brighter financial future.

How can I negotiate a higher hourly rate?

+Negotiating a higher hourly rate requires a strategic approach. Highlight your unique skills, experience, and contributions to the organization. Research industry standards and compare your skills to the job market. Prepare a compelling case for why your skills warrant a higher rate, and be confident in your negotiations.

What are some side hustles to boost my earnings?

+There are numerous side hustles to consider, depending on your skills and interests. Some popular options include freelance writing, graphic design, tutoring, ride-sharing services, and online marketplaces like Etsy or eBay. Explore platforms like Upwork or Fiverr to find freelance opportunities in your field.

How can I manage my finances effectively?

+Effective financial management involves creating a budget, tracking your expenses, and setting financial goals. Consider using budgeting apps or spreadsheets to monitor your income and expenses. Build an emergency fund, pay off high-interest debts, and explore investment opportunities to grow your wealth over time.