$22 an hour: Annual Earnings Breakdown

The take-home pay for an employee earning 22 per hour can vary significantly based on their tax bracket, state and local tax rates, and any additional deductions. As a rough estimate, taxes and deductions could reduce the annual earnings by approximately 20-30%. This means that the take-home pay for an individual earning 45,760 annually could range from 32,032 to 36,656.

Can I live comfortably on an annual income of 45,760 before taxes and deductions?">How much does an employee earning 22 per hour take home annually after taxes and deductions?

+The take-home pay for an employee earning 22 per hour can vary significantly based on their tax bracket, state and local tax rates, and any additional deductions. As a rough estimate, taxes and deductions could reduce the annual earnings by approximately 20-30%. This means that the take-home pay for an individual earning 45,760 annually could range from 32,032 to 36,656.

Earning an hourly wage of $22 can be a comfortable income for many individuals, especially those seeking flexibility and diverse work opportunities. This wage rate, often associated with skilled trades, certain service industries, and specific entry-level roles, can provide a decent living and a solid foundation for personal financial growth. Let's delve into the annual earnings breakdown, exploring the various aspects that contribute to the overall financial picture.

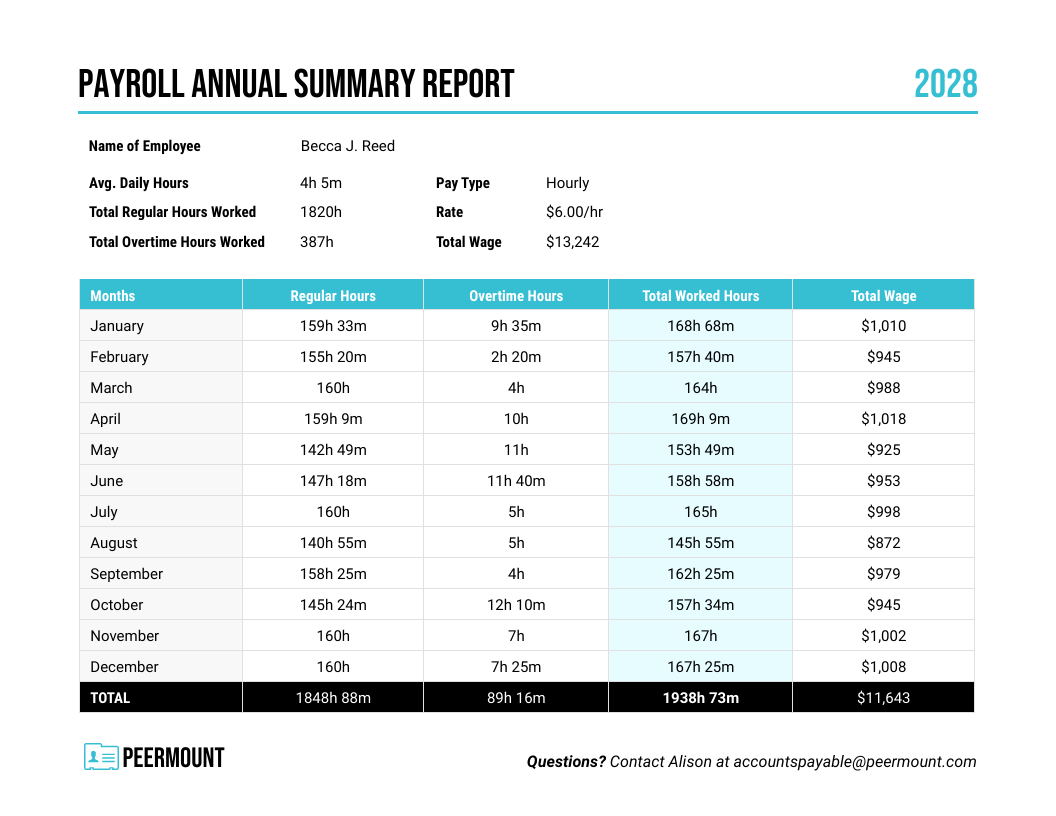

Understanding the Annual Earnings

When working at an hourly rate of 22, the annual income can vary significantly based on several factors, including the number of hours worked per week, the number of weeks worked annually, and any additional bonuses or benefits. On average, a full-time employee working 40 hours a week for 52 weeks a year would earn an annual income of 45,760 before taxes and deductions.

However, it's essential to note that the workweek structure and the number of working weeks in a year can differ. For instance, some industries or roles might operate on a 37.5-hour workweek, while others might have part-time schedules or seasonal variations. These factors can significantly impact the annual earnings.

| Work Hours | Annual Earnings |

|---|---|

| 40 hours/week | $45,760 |

| 37.5 hours/week | $42,450 |

| 30 hours/week | $34,200 |

These estimates provide a baseline, but it's crucial to consider that overtime pay, bonuses, and benefits can further enhance earnings. Additionally, the cost of living and personal financial goals can greatly influence the perceived value of this hourly wage.

Breaking Down the Earnings

To understand the financial implications of earning $22 per hour, let’s break down the earnings into different components and analyze their impact.

Regular Earnings

The core of the annual earnings comes from the regular work hours. For a 40-hour workweek, this amounts to 880 per week, which over 52 weeks totals 45,760. This figure serves as the foundation for the annual income.

Overtime and Bonuses

Many industries offer overtime pay for hours worked beyond the regular workweek. Depending on the employment terms, overtime pay can be a significant boost to the annual earnings. For instance, if an employee works an additional 10 hours of overtime per week at time-and-a-half (33 per hour), their annual earnings could increase by 8,320, pushing the total to $54,080.

Additionally, bonuses, whether performance-based or seasonal, can further enhance the annual income. These bonuses can vary greatly, but a typical bonus of 5% of the annual earnings would add $2,288 to the total, resulting in $48,048.

Benefits and Perks

Employee benefits and perks can greatly contribute to the overall value of the hourly wage. These might include healthcare coverage, retirement plans, paid time off, or other company-provided benefits. While the value of these benefits can be hard to quantify, they significantly impact an individual’s financial security and well-being.

For instance, healthcare coverage can save an individual thousands of dollars annually, especially with comprehensive plans. Retirement plans, such as a 401(k) with employer matching, can also provide substantial long-term benefits. Paid time off allows for rest and relaxation, improving overall quality of life and potentially increasing productivity.

Taxes and Deductions

It’s essential to understand that the gross annual earnings will be subject to taxes and deductions. The amount deducted will depend on various factors, including the employee’s tax bracket, state and local tax rates, and any additional deductions for healthcare or retirement plans.

As a rough estimate, taxes and deductions could reduce the annual earnings by approximately 20-30%. This means that the take-home pay for an individual earning $45,760 annually could range from $32,032 to $36,656.

Financial Planning and Lifestyle

Earning $22 per hour can provide a comfortable lifestyle, but it’s essential to consider individual financial goals and the cost of living in specific regions. Here are some key considerations:

- Budgeting: Creating a detailed budget can help manage finances effectively. Tracking expenses and setting financial goals can ensure that the earnings are utilized efficiently.

- Savings and Investments: It's crucial to save for emergencies and long-term goals. Investing in stocks, bonds, or real estate can also provide opportunities for wealth growth.

- Debt Management: Prioritizing debt repayment, especially high-interest debt, can improve financial stability and overall wealth.

- Cost of Living: The cost of living varies significantly across different regions. In high-cost areas, $22 per hour might not provide the same purchasing power as in more affordable regions.

- Career Growth: Exploring opportunities for skill development and career advancement can lead to higher-paying roles and increased earnings potential.

The Impact of Inflation

Inflation, the rate at which the general level of prices for goods and services is rising, can significantly impact the purchasing power of an hourly wage. Over time, the value of $22 per hour might decrease, especially if wages don’t keep pace with inflation.

To combat the effects of inflation, it's essential to explore opportunities for income growth, whether through career advancement, skill development, or additional income streams. Additionally, investing in assets that historically outperform inflation, such as stocks or real estate, can help preserve and grow wealth over time.

Conclusion

Earning $22 per hour can provide a solid financial foundation, offering opportunities for a comfortable lifestyle, savings, and investments. However, it’s crucial to consider individual circumstances, financial goals, and the cost of living. By understanding the various components of the annual earnings and implementing thoughtful financial planning, individuals can maximize the value of their hourly wage and achieve long-term financial success.

Frequently Asked Questions

How much does an employee earning 22 per hour take home annually after taxes and deductions?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The take-home pay for an employee earning 22 per hour can vary significantly based on their tax bracket, state and local tax rates, and any additional deductions. As a rough estimate, taxes and deductions could reduce the annual earnings by approximately 20-30%. This means that the take-home pay for an individual earning 45,760 annually could range from 32,032 to 36,656.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I live comfortably on an annual income of 45,760 before taxes and deductions?

+Whether you can live comfortably on 45,760 annually before taxes and deductions depends on various factors, including your location, lifestyle, and financial goals. In areas with a lower cost of living, this income can provide a comfortable lifestyle. However, in high-cost regions, it might be challenging to cover all expenses without careful budgeting and financial planning.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What are some strategies to maximize earnings while working at an hourly rate of 22? +

To maximize earnings at an hourly rate of $22, consider the following strategies:

- Work overtime: If your employer offers overtime pay, working additional hours can significantly boost your annual income.

- Negotiate bonuses: Discuss performance-based or seasonal bonuses with your employer. Negotiating for higher bonuses can enhance your earnings.

- Explore career advancement: Look for opportunities to advance your career and increase your earning potential. This might involve additional training, certifications, or taking on new responsibilities.

- Seek additional income streams: Consider freelance work or side hustles to supplement your primary income.