2 10 Net 60: Decoding the Payment Terms

In the world of business and finance, understanding payment terms is crucial for maintaining healthy cash flow and managing financial relationships. One commonly used payment term is "2 10 Net 60," a phrase that might sound cryptic to those unfamiliar with the terminology. In this article, we will delve into the details of this payment term, breaking down its components and exploring its implications for both buyers and sellers. By the end, you'll have a comprehensive understanding of how this payment structure works and why it is utilized in various industries.

Unraveling the 2 10 Net 60 Enigma

The payment term “2 10 Net 60” is a specific arrangement between a seller and a buyer, outlining the terms and timing of payment for goods or services rendered. Let’s dissect each part of this term to grasp its significance:

The Components of 2 10 Net 60

- 2: This number represents a 2% early payment discount. It signifies that if the buyer pays the invoice within 10 days of the invoice date, they are eligible for a 2% discount on the total amount due.

- 10: The number 10 indicates the maximum days for the early payment discount to be applicable. In this case, the buyer has 10 days from the invoice date to take advantage of the early payment discount.

- Net: The term “Net” is a common indicator in payment terms and means that the full invoice amount is due on a specific date. In our case, it separates the early payment discount period from the full payment due date.

- 60: This number represents the number of days from the invoice date until the full amount is due. In this payment term, the buyer has 60 days from the invoice date to pay the full invoice amount without incurring any late fees or penalties.

| Payment Term Component | Description |

|---|---|

| 2% | Early payment discount percentage |

| 10 Days | Maximum time frame for the early payment discount |

| Net | Indicating the full invoice amount due |

| 60 Days | Timeframe for full payment without late fees |

Benefits for Buyers and Sellers

The 2 10 Net 60 payment term offers advantages to both buyers and sellers. For buyers, it provides flexibility in managing their cash flow. By taking advantage of the early payment discount, buyers can reduce their overall expenses by 2%. This incentive encourages prompt payments and helps buyers optimize their financial resources. On the other hand, sellers benefit from the extended payment period, as they can maintain a healthy cash flow while still offering a discount to encourage timely payments.

How 2 10 Net 60 Works in Practice

To illustrate how the 2 10 Net 60 payment term operates, let’s consider a hypothetical scenario involving a wholesale bakery, Fresh Baked Delights, and a local café, Brewed Bliss. Fresh Baked Delights offers the 2 10 Net 60 payment term to its customers, including Brewed Bliss, which regularly purchases fresh pastries and bread.

Scenario: Fresh Baked Delights and Brewed Bliss

On June 1st, Fresh Baked Delights delivers an invoice to Brewed Bliss for a total amount of 1,000, with the payment term of 2 10 Net 60. Here's how the payment schedule would work:</p> <ul> <li><strong>Early Payment Discount Period (2%):</strong> <em>Brewed Bliss</em> has until June 11th (10 days from the invoice date) to take advantage of the 2% early payment discount. If they pay the invoice by this date, they will receive a 20 discount (1,000 x 2% = 20), reducing the total amount due to 980.</li> <li><strong>Full Payment Due Date (Net 60):</strong> If <em>Brewed Bliss</em> chooses not to pay early, they have until July 31st (60 days from the invoice date) to pay the full amount of 1,000. Failure to pay by this date may result in late fees or other penalties as specified in the terms of agreement.

The Impact on Cash Flow and Financial Management

The 2 10 Net 60 payment term has a significant impact on the cash flow and financial management of both buyers and sellers. For buyers, it provides an opportunity to reduce costs by taking advantage of the early payment discount. This can be especially beneficial for businesses with tight cash flow situations, as it allows them to optimize their expenses and potentially free up funds for other critical business needs.

On the seller's side, the extended payment period of 60 days provides a buffer for managing cash flow. It allows sellers to receive payment within a reasonable timeframe while still offering a discount for early payments. This balance between encouraging timely payments and maintaining a healthy cash flow is a key advantage of the 2 10 Net 60 term.

Managing Cash Flow and Financial Risks

While the 2 10 Net 60 term offers flexibility, it also comes with certain financial risks. Buyers must carefully manage their cash flow to ensure they can take advantage of the early payment discount without straining their finances. On the other hand, sellers must be prepared for the possibility of late payments and have strategies in place to mitigate the impact of delayed payments on their cash flow.

Negotiating Payment Terms: A Strategic Move

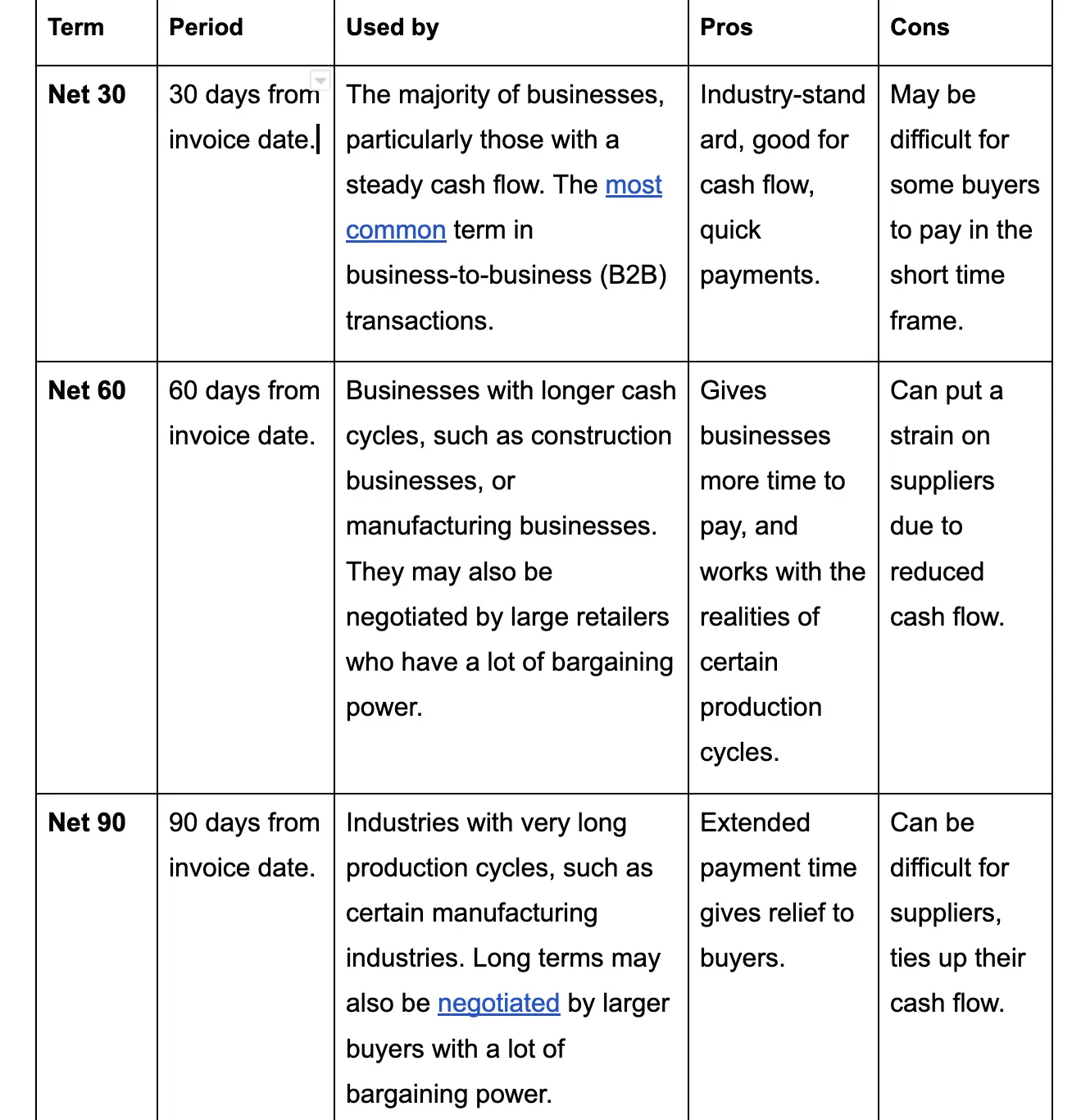

The payment term 2 10 Net 60 is just one example of the many payment structures used in business. It is essential for both buyers and sellers to understand the implications of different payment terms and negotiate terms that align with their financial goals and capabilities.

Factors to Consider in Negotiations

- Industry Standards: Different industries may have varying payment terms. Understanding the standard practices in your industry can provide a baseline for negotiations.

- Cash Flow Needs: Assess your business’s cash flow requirements and financial health. Determine whether an early payment discount or a longer payment period is more beneficial for your business.

- Relationship with the Counterparty: The nature of your relationship with the other party can influence the negotiation process. Established relationships may offer more flexibility, while new partnerships might require a more cautious approach.

- Risk Assessment: Evaluate the financial stability and payment history of the counterparty. Assessing the risk of late payments is crucial for managing potential financial losses.

Conclusion: The Power of Payment Term Flexibility

The 2 10 Net 60 payment term showcases the importance of flexibility in business transactions. By offering an early payment discount and an extended payment period, this term encourages prompt payments while accommodating the financial needs of both buyers and sellers. It is a prime example of how payment terms can be strategically negotiated to benefit all parties involved.

Understanding payment terms like 2 10 Net 60 is essential for businesses to optimize their financial operations and maintain healthy relationships with their counterparts. By carefully considering the implications of different payment structures, businesses can navigate the complex world of financial transactions with confidence and success.

What happens if a buyer misses the early payment discount period?

+If a buyer misses the early payment discount period, they will still have the obligation to pay the full invoice amount by the Net 60 date. Failure to do so may result in late fees or other penalties as outlined in the payment terms.

Are there any industries where the 2 10 Net 60 term is commonly used?

+The 2 10 Net 60 term is versatile and can be found in various industries, including wholesale, retail, and manufacturing. Its flexibility makes it appealing to businesses across different sectors.

Can sellers offer alternative payment terms to specific buyers?

+Yes, sellers often have the flexibility to negotiate and offer alternative payment terms to specific buyers based on their relationship, financial history, and individual needs. This allows for a more personalized approach to financial transactions.