Exchange 00 CAD to USD: 3 Easy Steps

The Canadian dollar and the US dollar are two of the most widely traded currencies in the world. With frequent fluctuations in the foreign exchange market, understanding how to convert currencies is essential, especially for individuals and businesses engaged in international transactions or travel. This article will guide you through the process of converting Canadian dollars (CAD) to US dollars (USD) with three simple steps.

Understanding the Exchange Rate

Before we dive into the conversion process, it’s crucial to comprehend the concept of exchange rates. An exchange rate is the value of one currency in relation to another. It dictates how much of one currency you need to obtain a specific amount of another. Exchange rates are subject to constant change due to various economic factors, market dynamics, and geopolitical events.

The Canadian dollar (CAD) is the official currency of Canada, issued and regulated by the Bank of Canada. Its value is determined by the supply and demand dynamics in the foreign exchange market. Similarly, the US dollar (USD) is the official currency of the United States, and its exchange rate with other currencies, including CAD, plays a significant role in international trade and finance.

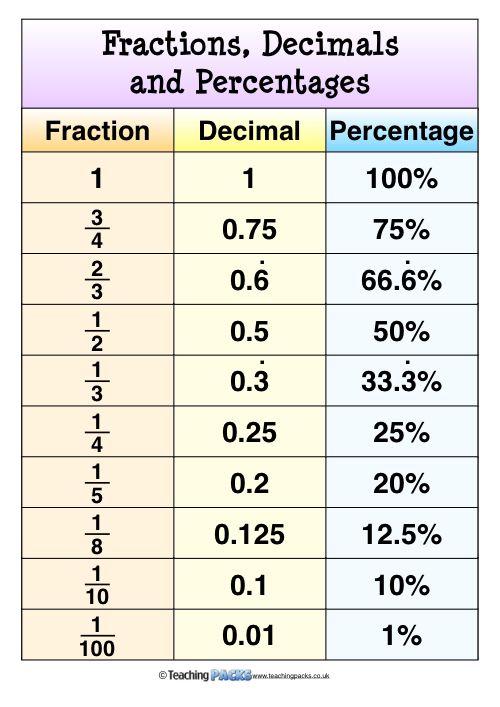

When exchanging CAD to USD, the exchange rate tells us how many US dollars we can get for a certain amount of Canadian dollars. For instance, if the exchange rate is 1 CAD = 0.75 USD, it means that one Canadian dollar is worth 0.75 US dollars. This rate can vary, and it's essential to check the current exchange rate before making any currency conversions.

Factors Influencing Exchange Rates

Several factors can influence the exchange rate between CAD and USD:

- Economic Performance: The health of the Canadian and US economies, including GDP growth, employment rates, and inflation, can impact the demand for each currency and, consequently, the exchange rate.

- Interest Rates: Central banks’ interest rate decisions can affect currency values. Higher interest rates often make a currency more attractive to investors, increasing its value.

- Political Stability: Political events and policies in both countries can impact investor confidence and, therefore, currency exchange rates.

- Trade Relations: The volume and value of trade between Canada and the US can influence the demand for each currency.

- Market Sentiment: Market sentiment and investor expectations can drive short-term fluctuations in exchange rates.

Staying informed about these factors and regularly checking the exchange rate is essential when planning to convert currencies.

Step 1: Check the Current Exchange Rate

The first step in converting CAD to USD is to determine the current exchange rate. Exchange rates are dynamic and can change rapidly, so it’s crucial to obtain the most up-to-date rate before proceeding with the conversion.

There are several ways to check the exchange rate:

- Online Currency Converters: Numerous websites and mobile apps provide real-time currency conversion tools. Simply enter the amount of CAD you wish to convert, and the converter will display the equivalent USD amount based on the current exchange rate.

- Financial News Websites: Reputable financial news platforms often have sections dedicated to currency exchange rates. These sites provide detailed information on various currency pairs, including CAD/USD.

- Bank or Broker Websites: Major financial institutions and currency brokers often publish exchange rates on their websites. These rates may vary slightly from the market rate, but they can give you a good estimate.

- Foreign Exchange Brokers: If you're dealing with a significant amount of currency, it's advisable to consult a professional foreign exchange broker. They can provide accurate and up-to-date exchange rates and offer personalized advice.

When checking the exchange rate, ensure you are using a reputable source to obtain the most accurate information. Additionally, be aware that the exchange rate you see may differ slightly from the rate you receive when actually exchanging the currency, especially if you're converting a large sum.

Example: Current Exchange Rate

Let’s say we want to convert CAD 1,000 to USD. We check the current exchange rate and find that it is 1 CAD = 0.76 USD. This means that for every Canadian dollar, we will receive approximately 0.76 US dollars.

| Canadian Dollar (CAD) | US Dollar (USD) |

|---|---|

| 1 CAD | 0.76 USD |

Step 2: Calculate the Amount in USD

Once you have the current exchange rate, the next step is to calculate the amount of USD you will receive for the CAD you wish to convert. This calculation is straightforward and involves multiplying the amount of CAD by the exchange rate.

Using our previous example, we have CAD 1,000 and an exchange rate of 1 CAD = 0.76 USD. To find out how much USD we will get, we multiply:

CAD 1,000 x 0.76 USD/CAD = USD 760

Therefore, with the given exchange rate, converting CAD 1,000 will result in receiving approximately USD 760.

Calculating with Different Amounts

Let’s look at a few more examples to understand how this calculation works with different amounts:

- If you want to convert CAD 500, the calculation would be: CAD 500 x 0.76 USD/CAD = USD 380

- For CAD 2,000, the calculation is: CAD 2,000 x 0.76 USD/CAD = USD 1,520

- And for CAD 10,000, it becomes: CAD 10,000 x 0.76 USD/CAD = USD 7,600

As you can see, the amount of USD you receive is directly proportional to the amount of CAD you start with and the exchange rate.

Step 3: Execute the Currency Exchange

Now that we have calculated the amount of USD we will receive, it’s time to execute the currency exchange. There are several ways to go about this, depending on your specific needs and circumstances.

Using a Bank or Currency Exchange Service

One of the most common methods is to visit a local bank or a dedicated currency exchange service provider. These institutions often have physical locations where you can bring your CAD and exchange it for USD. They may offer different exchange rates and fees, so it’s beneficial to shop around and compare offers.

When using a bank or currency exchange service, consider the following:

- Exchange Rates: Banks and currency exchange services typically have their own exchange rates, which may differ slightly from the market rate. Compare these rates to ensure you're getting a competitive deal.

- Fees: Currency exchange services often charge fees for their services. These fees can be in the form of a flat rate or a percentage of the transaction amount. Be aware of these fees and calculate the total cost of the exchange.

- Identification: You may need to provide valid identification, such as a passport or driver's license, when exchanging currency.

- Minimum/Maximum Amounts: Some institutions may have minimum or maximum transaction limits. Check these limits to ensure they align with your needs.

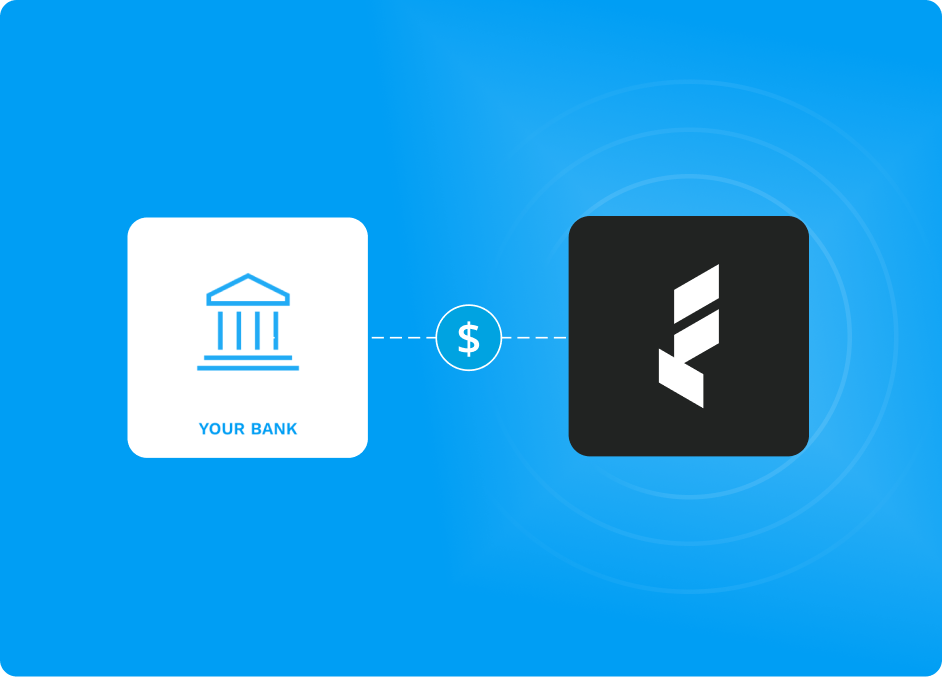

Online Currency Exchange Platforms

In today's digital age, online currency exchange platforms have become increasingly popular. These platforms allow you to exchange currencies electronically, often with more competitive exchange rates and lower fees compared to traditional methods.

When using an online currency exchange platform, consider the following:

- Security: Ensure the platform is reputable and has robust security measures to protect your personal and financial information.

- Registration and Verification: You may need to register an account and verify your identity before making transactions.

- Exchange Rates and Fees: Online platforms often provide competitive exchange rates and transparent fee structures. Compare these rates and fees to find the best option for your transaction.

- Transfer Methods: Online platforms offer various transfer methods, such as bank transfers, credit/debit cards, or digital wallets. Choose the method that suits your preferences and needs.

Once you've selected a suitable method, follow the instructions provided by the bank, currency exchange service, or online platform to complete the currency exchange process. Make sure to review the terms and conditions, including any potential fees or charges, before finalizing the transaction.

Tips for a Successful Currency Exchange

To ensure a smooth and advantageous currency exchange, consider the following tips:

- Plan Ahead: If you know you’ll need to exchange currency in the future, plan ahead and monitor the exchange rate. This way, you can take advantage of favorable rates when they arise.

- Shop Around: Compare exchange rates and fees from multiple sources, whether banks, currency exchange services, or online platforms. This can help you find the best deal and save money.

- Consider the Transaction Amount: Larger transactions may qualify for better exchange rates or lower fees. If you’re converting a significant amount of currency, it’s worth exploring these options.

- Avoid Dynamic Currency Conversion: When using your credit or debit card abroad, you may be offered Dynamic Currency Conversion (DCC). This service converts the transaction amount into your home currency, but it often comes with unfavorable exchange rates and fees. It’s generally advisable to decline DCC and let the merchant process the transaction in the local currency.

- Stay Informed: Keep yourself updated on economic news and market trends that may impact exchange rates. This knowledge can help you make more informed decisions about when to exchange currency.

By following these steps and tips, you can confidently convert CAD to USD and navigate the world of currency exchange with ease.

Frequently Asked Questions

How often do exchange rates change?

+Exchange rates can change multiple times a day, influenced by various economic and geopolitical factors. Major announcements, interest rate decisions, and market sentiment can cause sudden fluctuations.

Are there any hidden fees when exchanging currency?

+Some banks and currency exchange services may charge hidden fees, such as commission fees or administration charges. It’s crucial to ask about all applicable fees before initiating the exchange.

Can I negotiate the exchange rate?

+Negotiating exchange rates is more common for large transactions or when dealing with foreign exchange brokers. For smaller amounts, the rates are typically predetermined, but it doesn’t hurt to inquire about potential discounts.

What is the best time to exchange currency?

+The best time to exchange currency depends on various factors, including market trends and your individual needs. Generally, it’s advisable to monitor the exchange rate and exchange currency when the rate is favorable and stable.

Are there any risks associated with online currency exchange platforms?

+While online currency exchange platforms can offer competitive rates, there are potential risks. Ensure you choose a reputable platform with robust security measures. Always research and read reviews before providing any personal or financial information.